Investment Grade Scoring: Decoding the Language of Credit Ratings

In institutional debt financing, investment grade scoring plays a pivotal role in assessing the creditworthiness of companies and governments, guiding investors’ decisions and shaping the dynamics of financial markets. This scoring system, meticulously developed and maintained by credit rating agencies, serves as a compass for navigating the complex terrain of credit risk.

At its core, investment grade scoring is a methodical process that evaluates the ability of an entity to meet its financial obligations, such as debt repayment or interest payments. This assessment is crucial for investors, lenders, and other market participants who seek to mitigate risk and make informed decisions about where to allocate their capital.

The concept of investment grade scoring is deeply intertwined with the workings of credit rating agencies, which act as independent arbiters in the financial landscape. These agencies, through rigorous analysis and well-defined rating scales, assign alphanumeric symbols or grades to represent the creditworthiness of issuers, such as corporations, municipalities, or sovereign nations.

The significance of investment grade scoring cannot be overstated. It influences the cost of borrowing for entities, as higher credit ratings often translate to lower interest rates and better access to capital markets. Conversely, lower ratings can lead to increased borrowing costs and restricted access to financing, potentially hampering growth and investment opportunities.

Understanding Credit Rating Agencies

Credit rating agencies have a long and storied history, tracing their roots back to the early 20th century when the need for independent assessments of creditworthiness became increasingly important. Over time, these agencies have evolved into powerful institutions that wield significant influence over global financial markets.

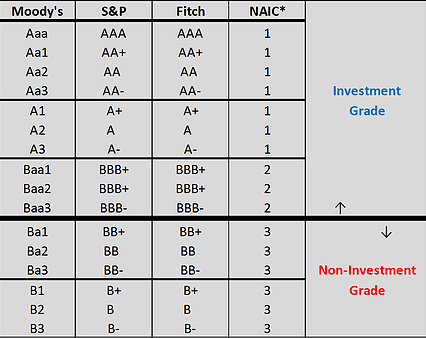

Among the most prominent players in the credit rating industry are the “Big Three” – S&P Global, Moody’s, and Fitch Ratings. These agencies have established themselves as the leading authorities in assessing credit risk, employing teams of highly skilled analysts and proprietary methodologies to scrutinize the financial health of issuers.

S&P Global, formerly known as Standard & Poor’s, has been a pioneering force in credit analysis since its inception in 1860. Moody’s, founded in 1909, is renowned for its extensive research and analytical capabilities. Fitch Ratings, established in 1913, has built a reputation for its rigorous approach and global coverage.

The process of assessing credit risk by these agencies is a meticulous undertaking that involves analyzing a multitude of factors, including financial statements, industry dynamics, management quality, and economic conditions. Their teams of analysts delve into vast amounts of data, applying time-tested models and leveraging their collective expertise to arrive at comprehensive credit ratings.

While the specific methodologies employed by each agency may vary, the common goal is to provide objective and transparent assessments of an issuer’s ability to meet its financial obligations. These assessments are disseminated to market participants, influencing their investment decisions and shaping the flow of capital within financial markets.

The Credit Rating Scale Explained

At the heart of investment grade scoring lies the credit rating scale, a standardized system that assigns alphanumeric symbols to represent varying levels of creditworthiness. This scale serves as a universal language, allowing investors and market participants to quickly grasp the relative risk associated with a particular investment.

The credit rating scale typically ranges from the highest investment grade ratings, such as AAA or Aaa, to the lowest speculative or non-investment grade ratings, like C or D. Each rating agency may have slight variations in their specific scales, but the general principles remain consistent across the industry.

Investment grade ratings, typically ranging from AAA/Aaa to BBB-/Baa3, signify a relatively low risk of default and are considered suitable for conservative investors seeking stable returns. These ratings indicate that the issuer has a strong capacity to meet their financial obligations and are less likely to experience financial distress.

On the other hand, speculative or non-investment grade ratings, often referred to as “junk” or “high-yield” bonds, fall below the BBB-/Baa3 threshold. These ratings suggest a higher risk of default and are associated with issuers that may face challenges in meeting their debt obligations. However, these investments also offer the potential for higher returns as compensation for the increased risk.

The distinction between investment grade and speculative grade ratings has significant implications for investors and issuers alike. Investment grade securities are generally considered safer and more liquid, making them attractive to institutional investors and pension funds with strict investment mandates. Conversely, speculative grade securities may appeal to more risk-tolerant investors seeking higher yields, but they also carry a greater risk of potential losses.

Factors Influencing Credit Ratings

Credit rating agencies employ a multitude of factors in their assessment of an issuer’s creditworthiness, each playing a crucial role in determining the final rating assigned. These factors encompass a wide range of economic, financial, and operational metrics, providing a holistic view of the issuer’s risk profile.

One of the primary factors considered is the issuer’s financial strength, which involves analyzing key ratios such as debt-to-equity, interest coverage, and cash flow. These metrics offer insights into the issuer’s ability to service debt obligations and maintain financial stability. Additionally, agencies scrutinize the issuer’s revenue streams, profitability, and overall financial performance to assess their resilience to economic downturns or industry-specific challenges.

Operational factors, including management quality, competitive positioning, and business strategy, also play a significant role in the rating process. Credit rating agencies evaluate the effectiveness of the issuer’s leadership team, their ability to navigate market dynamics, and their strategic vision for long-term growth and sustainability.

Furthermore, industry-specific factors are taken into account, recognizing that different sectors face unique challenges and opportunities. For instance, regulatory environments, technological disruptions, and market trends can significantly impact the creditworthiness of companies operating in industries such as energy, telecommunications, or healthcare.

Case studies of rating adjustments provide valuable insights into the impact of these factors on credit ratings. For example, a company’s rating may be downgraded due to deteriorating financial performance, excessive leverage, or operational missteps, leading to increased borrowing costs and potentially limiting access to capital markets. Conversely, prudent financial management, strategic acquisitions, or successful restructuring efforts can result in rating upgrades, unlocking new opportunities for growth and investment.

Investment Grade vs. Speculative Grade

The distinction between investment grade and speculative grade securities is a fundamental concept in investment grade scoring and carries significant implications for investors and issuers alike. This divide separates the relative safety and stability of investment grade securities from the higher risk, but potentially higher return, of speculative grade investments.

Investment grade securities, typically rated BBB-/Baa3 or higher, are considered lower-risk investments suitable for conservative portfolios. These securities are issued by entities with strong financial profiles, stable cash flows, and a proven track record of meeting their debt obligations. As a result, investment grade bonds tend to offer lower yields but provide a greater degree of principal protection and stability.

In contrast, speculative grade securities, often referred to as “high-yield” or “junk” bonds, are rated below BBB-/Baa3 and are associated with a higher risk of default. These securities are issued by companies or governments with weaker financial positions, higher leverage, or operating in more volatile industries. While speculative grade bonds offer the potential for higher returns, they also carry a greater risk of losses, including potential principal impairment or missed interest payments.

The risk and return profile of each category is distinctly different, and investors must carefully weigh their risk tolerance, investment objectives, and portfolio diversification strategies when considering exposure to these securities. Conservative investors, such as pension funds or risk-averse individuals, may gravitate towards investment grade securities, prioritizing capital preservation and steady income streams. Conversely, more aggressive investors may choose to allocate a portion of their portfolios to speculative grade bonds, seeking higher yields to compensate for the increased risk.

Investment strategies for navigating these grades often involve diversification across industries, maturities, and credit qualities. Portfolio managers may employ laddering strategies, where bonds with staggered maturities are held to mitigate interest rate risk, or engage in credit analysis to identify undervalued securities with attractive risk-reward profiles.

Additionally, investors may consider utilizing bond funds or exchange-traded funds (ETFs) that specialize in investment grade or speculative grade securities, allowing for professional management and diversification within a specific credit quality segment.

Criticism and Challenges Facing Credit Rating Agencies

While credit rating agencies play a vital role in the financial ecosystem, they have faced scrutiny and criticism over the years, particularly in the aftermath of major financial crises. Historical controversies have shed light on potential conflicts of interest, methodological flaws, and the agencies’ perceived failure to adequately assess and communicate risks.

One of the most notable controversies surrounding credit rating agencies occurred during the 2008 global financial crisis. Critics argued that the agencies were overly optimistic in their assessments of mortgage-backed securities and collateralized debt obligations, failing to recognize the inherent risks within these complex financial instruments. This alleged oversight contributed to the mispricing of risk and the subsequent collapse of the housing market, which precipitated the broader financial crisis.

In the aftermath of the crisis, regulatory bodies and policymakers sought to address the perceived shortcomings of credit rating agencies. Efforts were made to enhance transparency, reduce conflicts of interest, and improve the rating methodologies employed by these agencies. Measures such as the Dodd-Frank Act in the United States aimed to increase oversight and accountability within the credit rating industry.

Despite these reform efforts, credit rating agencies continue to face challenges and criticisms regarding their practices and independence. Concerns have been raised about the potential for rating shopping, where issuers may seek favorable ratings from agencies with more lenient standards or methodologies. Additionally, questions have been raised about the agencies’ ability to accurately assess the creditworthiness of complex financial instruments or emerging asset classes, such as cryptocurrencies or sustainable investments.

Furthermore, the growing reliance on alternative data sources and advanced analytical techniques has introduced new challenges for credit rating agencies. As the financial landscape evolves, these agencies must adapt their methodologies to incorporate non-traditional data points and leverage cutting-edge technologies to maintain their relevance and accuracy.

Ongoing debates surrounding the role, reliability, and accountability of credit rating agencies underscore the importance of continuous improvement and increased transparency within the industry. Regulators, market participants, and the agencies themselves must work collaboratively to address these challenges, ensuring that investment grade scoring remains a trusted and reliable tool in the assessment of credit risk.

The Future of Credit Rating and Investment Grade Scoring

As the financial landscape continues to evolve, driven by technological advancements and shifting market dynamics, the future of credit rating and investment grade scoring is poised for significant transformations. Emerging trends and innovations are reshaping the way creditworthiness is assessed, paving the way for more sophisticated and data-driven methodologies.

One notable trend is the integration of alternative data sources into credit risk analysis. Traditional financial statements and quantitative metrics are being supplemented with non-traditional data points, such as consumer behavior, social media sentiment, and environmental, social, and governance (ESG) factors. By leveraging these alternative data sources, credit rating agencies can gain deeper insights into an issuer’s risk profile and better anticipate potential challenges or opportunities.

Furthermore, the advent of advanced analytical techniques, including machine learning and artificial intelligence, is set to revolutionize investment grade scoring. These technologies enable the processing and analysis of vast amounts of data, identifying intricate patterns and relationships that may have been overlooked by traditional methods. By harnessing the power of these cutting-edge techniques, credit rating agencies can enhance the accuracy and timeliness of their assessments, providing more nuanced and actionable insights to market participants.

Additionally, the growing importance of sustainability and ESG considerations is shaping the future of credit rating methodologies. As investors increasingly prioritize responsible investing and stakeholder value, credit rating agencies are adapting their frameworks to incorporate ESG factors into their assessments. This shift reflects the recognition that environmental and social risks can have profound impacts on an entity’s long-term financial performance and creditworthiness.

As we look ahead, the future of investment grade scoring promises to be more data-driven, technologically advanced, and holistic in its approach. By embracing innovation and adapting to the evolving needs of financial markets, credit rating agencies can continue to play a vital role in facilitating informed investment decisions and promoting financial stability on a global scale.