Investment Grade: What It Means

Investment Grade denotes financial instruments and real estate investments with credit ratings of BBB-/Baa3 or above, representing exceptional creditworthiness and minimal default risk.

InvestmentGrade.com offers a comprehensive suite of investment grade capital and real estate solutions, including real estate investment sales, acquisitions, portfolio development, net lease, and credit tenant evaluations, institutional grade off-market multi-family acquisitions and dispositions, recapitalization, rate and term, and cash-out refinance of maturing CRE debt in all CRE Asset classes and for both investment grade and non investment grade tenants.

We specialize in providing high-quality investment opportunities that meet rigorous standards of creditworthiness and stability. These opportunities are tailored to individual investors, limited partners, general partners, and institutions.

Investment Grade Capital

Our capital solutions are focused exclusively on Commercial Real Estate (CRE) Debt, tailored to meet the complex needs of our clients. We offer rate and term refinancing, cash-out refinancing, and acquisition loans across all CRE sectors. We deliver competitive, flexible solutions designed to maximize the financial leverage and returns on your real estate assets. Whether you are looking to secure the best possible rate for a purchase or refinance, we streamline the process to help you achieve your capital objectives.

Commercial Asset Classes We Fund

Refinance Rate & Term or Cash Out Refinance, Acquisitions Loans. With nearly one thousand lenders and ten thousand programs, Investment Grade partners with CommLoan to ensure you get the the best rates, terms, and covenants for your Commercial Real Estate Property.

NNN

Single Tenant Net Lease Funding all major Investment Grade and non-Investment Grade and Franchise Tenants. From Retail to QSR, Quick Service Restaurants to Automotive to Banks to Pharmacies.

Multi Family

Loans for all Apartment Building types, from Co-Op to Condo to Garden to Mid Rise to Town Homes, including Mixed Use, Active Adult, Student Housing, Affordable & Workforce Housing, Build to Rent

Industrial

Funding Flex Space / R&D to Manufacturing, Heavy Industrial, Warehouse, Bulk District & Warehouse Cold Storage. *Also structuring Sales-Leasebacks for select Industrial NNN tenants.

Healthcare

Loans for Specialty Care, Urgent Care, Ambulatory Surgery Centers, Dialysis Clinics, Dental Clinics, Medical Offices, Assisted Living, Inpatient Facilities, Outpatient Facilities, Skilled Nursing Memory Care *Also structuring Sales-Leasebacks and Build To Suit Expansion for select Healthcare NNN tenants

Hospitality

Refinance, Cash Out & Acquisition Loans for Flagged/Unflagged Conversions, Flagged/Unflagged Full Service, Flagged/Unflagged Limited Service, Flagged/Unflagged Suite Extended Stays. Micro Resorts, Campgrounds & Investment Grade STR

Special Use

Financing & Refinancing Automotive NNN, Auto Body/Service & Repair, Auto Dealerships, Car Washes, Gas Stations, Convenience Stores, Day Care Facilities, Restaurants, Single Family Home Portfolios

Investment Grade Real Estate

Acquisitions

Our acquisitions focus is centered around delivering investment opportunities that meet the highest standards of security and performance. We offer:

- Investment Grade NNN Credit Tenants: We specialize in acquiring properties leased to creditworthy, investment-grade tenants on triple net (NNN) leases. These properties offer a stable and predictable income stream, supported by well-established corporations that assume the majority of operational expenses. Explore investment opportunities that prioritize financial strength and dependability, much like those available through platforms like InvestmentGradeIncomeProperty.com.

- Institutional Grade Multifamily: We target off-market multifamily properties with 50+ units, specifically those that align with institutional-grade investment standards. Our acquisitions team leverages a deep network to source exclusive opportunities that provide significant growth potential. These properties are carefully vetted to ensure quality and stability, with branding as “Investment Grade Institutional Acquisitions” to deliver unparalleled opportunities for discerning investors.

Dispositions

Investment Grade provides a streamlined and effective solution for property dispositions, covering both on- and off-market transactions in all 50 states. Our commission rates start from 1% for mid-market commercial real estate assets from $2M to $20M+, offering competitive pricing whether you’re looking to sell an asset quietly off-market or to gain maximum exposure through broad marketing efforts. Our expertise ensures that your asset achieves its highest potential value, leveraging market knowledge and a robust buyer network.

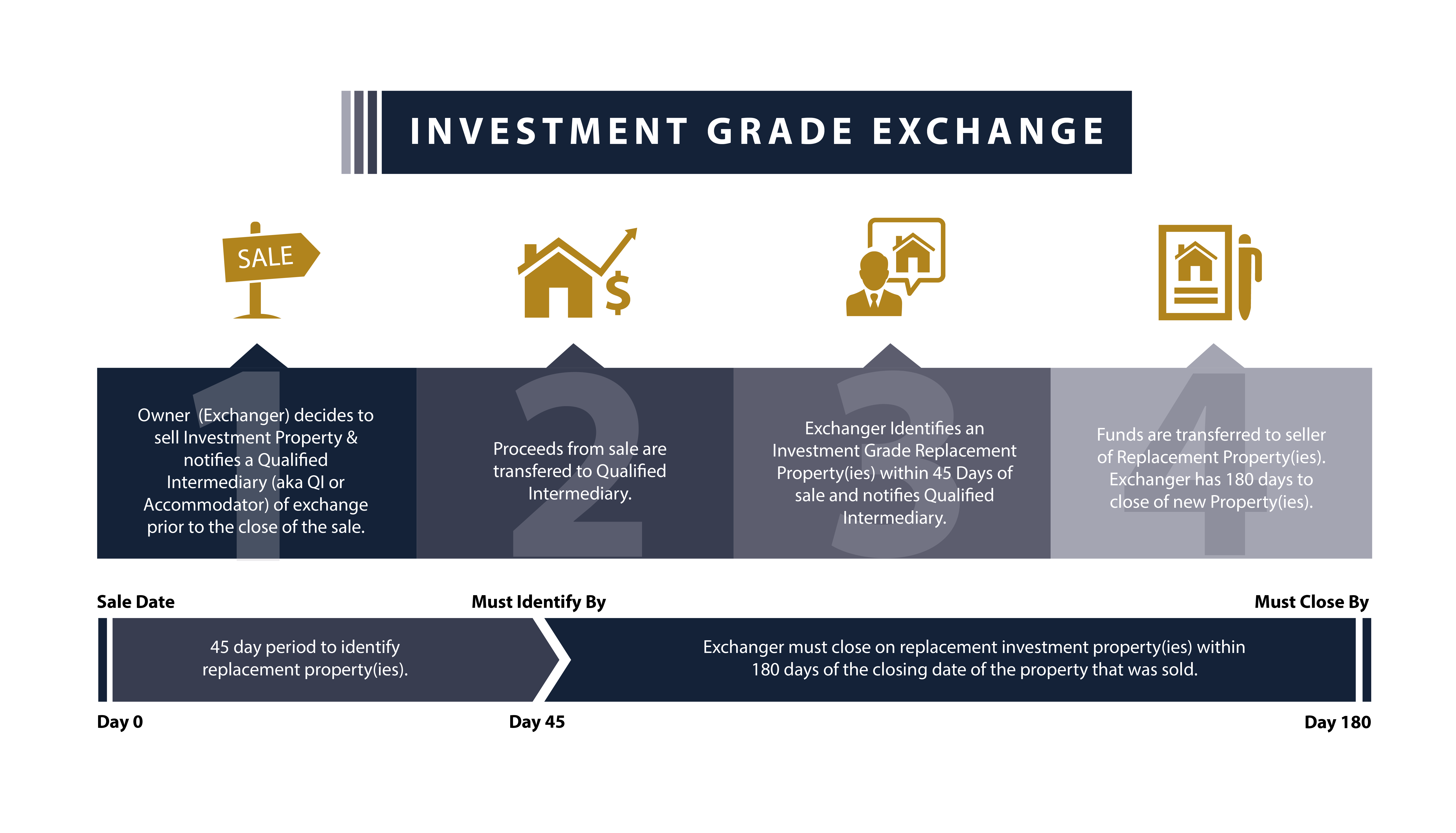

Exchanges

Take advantage of our expertise in 1031 Exchanges to defer capital gains and maximize your investment returns. We assist investors in navigating the complexities of the 1031 exchange process, allowing for a seamless transition from one investment property to another. Our tailored approach ensures compliance while aiming for the best possible outcomes, maintaining an investment grade focus on quality assets and long-term value.

Syndications

Does your syndication “make the grade”? Our Syndication Grading service provides in-depth analysis for Limited Partners (LPs), focusing on the alignment between investor interests, deal economics, and sponsor execution. We ensure that your syndication meets the rigorous standards expected by institutional investors. With a focus on transparency, financial stability, and market viability, our grading process helps investors (limited partners) evaluate syndicated real estate properties and funds.