Investment Grade

Company

-

Investment Grade REIT Sector Report Card

After three years of historic underperformance, the publicly traded REIT universe is beginning to find its footing again. Entering 2025, REITs had accumulated a performance deficit of over 45 percentage points relative to the S&P 500—one of the largest gaps in modern market history. This valuation disconnect was driven not by failing fundamentals, but by…

-

Investment Grade M&A: Becoming an Investment Grade Company and Maximizing Your Exit Value

Selling your business is one of the most critical decisions you will ever make, not just financially, but also emotionally and strategically. The traditional M&A landscape is often transactional, focused narrowly on financial metrics, leaving substantial value on the table. Investment Grade M&A offers an entirely different approach: positioning your business strategically to become an…

-

Investment Grade Credit Tenant Ratings

7th March 2026 | by the Investment Grade Team

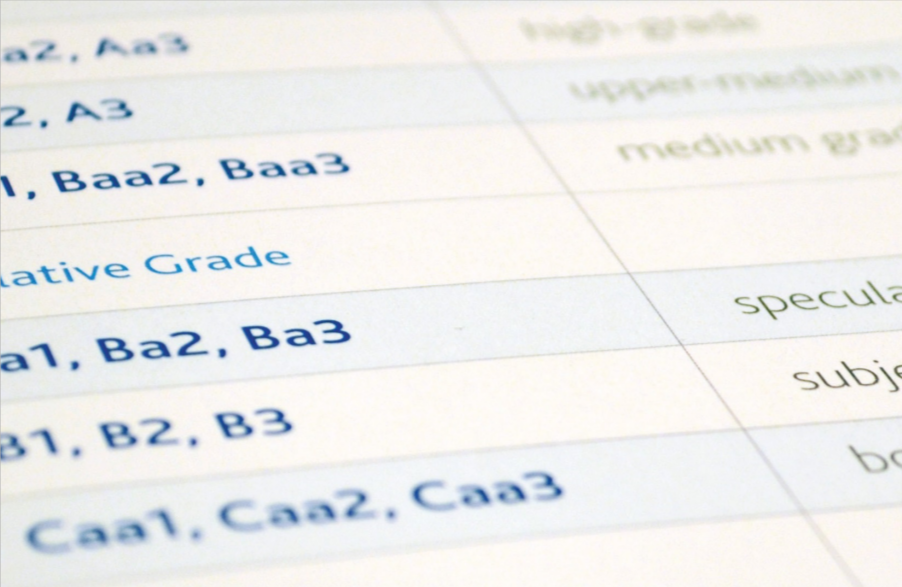

Investment Grade Credit Rating Chart Index INVESTMENT GRADE TIER GRADE S&P MOODY’S PRIME AAA AAA Aaa HIGH GRADE AA+ AA+ Aa1 AA AA Aa2 AA- AA- Aa3 UPPER MEDIUM GRADE A+ A+ A1 A A A2 A- A- A3 LOWER MEDIUM GRADE BBB+ BBB+ Baa1 BBB BBB Baa2 BBB- BBB- Baa3 NON-INVESTMENT GRADE SPECULATIVE BB+…

-

Moody’s 2025 Refresh: What Investors Need to Know About the New Rating Landscape

7th March 2026 | by the Investment Grade Team

Moody’s 2025 Ratings Manual: Redefining Transparency and Clarity in Credit Markets Moody’s has unveiled its updated guide to investment grade rating symbols and definitions—a comprehensive reference that promises greater clarity in assessing credit risk in an ever‐evolving global financial landscape. Published as of January 2, 2025, the document details the evolution of Moody’s rating system—a…

-

Beyond Numbers: Elevating Corporate Reporting to Investment Grade

The landscape of investment grade corporate reporting has undergone a dramatic transformation in recent decades, driven by the evolving demands of investors, stakeholders, and regulatory bodies. Traditional financial reporting, once deemed sufficient to gauge an organization’s health, is now seen as incomplete in capturing the true value of a business. Today’s investment environment demands more…

-

Unlocking Value with Investment Grade Sale Leasebacks: A Strategic Guide for Business Owners

7th March 2026 | by the Investment Grade Team

The Strategic Power of Investment Grade Sale Leasebacks in Commercial Real Estate Sale-leasebacks have emerged as a sophisticated financial solution for business owners who own real estate across a wide range of asset classes. By converting real estate assets into liquid capital while retaining operational control, this strategy offers businesses in healthcare, retail, industrial, and…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings