Investment Grade

Uncategorized

-

Benefits of Cost Segregation in Healthcare Real Estate

6th March 2026 | by the Investment Grade Team

Healthcare facilities—such as medical office buildings, surgical centers, dialysis clinics, and imaging suites—tend to have a higher proportion of specialized equipment and tenant-installed improvements than most other commercial asset classes. By accelerating depreciation on items like exam tables, imaging machines, lab casework, and specialty wiring, cost segregation unlocks greater early-year deductions that materially improve cash…

-

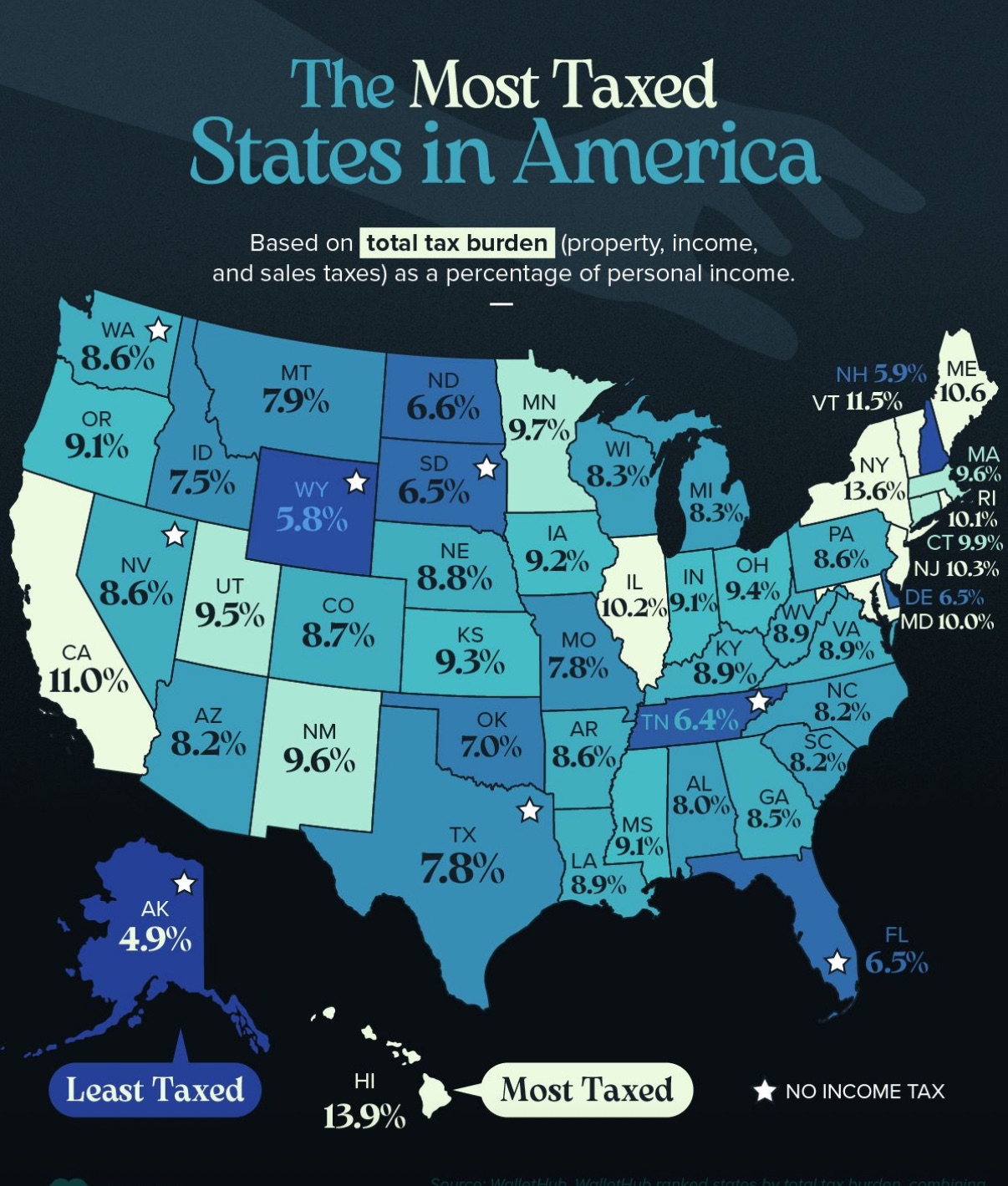

Investment‑Grade Tax‑Efficiency Scorecard: Ranking States by Tax Burden vs. NNN Cap Rates

6th March 2026 | by the Investment Grade Team

On a recent spring morning, investors at a private equity roundtable in downtown Chicago found themselves poring over a color‑coded map that had begun circulating across CRE investor circles. The map, drawn from WalletHub’s “Tax Burden by State in 2025,” laid bare a stark truth: where you choose to park your capital can shave—or pad—your…

-

Investment Grade Hospitality & NNN

6th March 2026 | by the Investment Grade Team

Below is a general overview of how and when major hotel brands (Hilton, Marriott, Choice Hotels, Extended Stay America) and some emerging hospitality concepts (e.g., glamping/experiential brands) may utilize a triple-net lease (NNN) structure. Because hotels often require intensive management and brand oversight, pure NNN leases are less common in hospitality than in other asset…

-

6th March 2026 | by the Investment Grade Team

Healthcare Franchise Industry in 2025: Overview and Opportunities The healthcare franchise sector in 2025 is robust and diverse, spanning urgent care clinics, home health services, specialty practices, and wellness centers. This industry has shown strong growth driven by demographic trends, rising consumer demand for convenient care, and innovation in telehealth. An aging U.S. population is…

-

Realty Income: A Deep Dive into the Monthly Dividend Titan

6th March 2026 | by the Investment Grade Team

For more than half a century, Realty Income (NYSE: O) has become synonymous with dependable, monthly dividend payouts—and for good reason. With a storied history that began in the 1960s and a public debut in 1994, the company has built one of the nation’s largest and most diversified single-tenant net lease portfolios. In this in-depth…

-

How Insurance Costs Are Effecting Affordable Housing

6th March 2026 | by the Investment Grade Team

In a candid post on Bluesky, Mark Cuban spotlighted what he believes will be the defining housing affordability issue in the coming years: skyrocketing home insurance costs. His prediction is particularly prescient for disaster-prone areas like Florida, where insurance premiums have already surged dramatically. Cuban’s assertion, “Home insurance in areas hit by repetitive disasters is…

-

How Investment Grade Ratings Affect Sovereign Debt and National Economies

6th March 2026 | by the Investment Grade Team

Overview: This article analyzes the impact of investment-grade ratings on sovereign debt and their ripple effects on national economies, borrowing costs, and global trade. What Is Sovereign Debt? Sovereign debt refers to the money borrowed by a country’s government from both domestic and international lenders. It is essentially the public debt held by national governments…

-

Making the Grade: Evaluating Viability in CRE Syndications with 10% Returns

6th March 2026 | by the Investment Grade Team

The Question of “Skinny” Returns in CRE Syndications Commercial real estate (CRE) syndication can be highly lucrative, but when you’re analyzing deals to synidcate with a projected 10% annualized return, you might wonder if it’s “too skinny” to pursue. For many seasoned investors, a 10% return may fall short of what is expected, especially when…

-

The Impact of Rising Insurance Costs on Maintaining Investment Grade CRE Properties

6th March 2026 | by the Investment Grade Team

The increasing cost of insurance, particularly in areas prone to natural disasters, is reshaping the commercial real estate (CRE) landscape, posing significant challenges to maintaining investment grade property standards. Over the past decade, insurance premiums have surged, driven by the heightened frequency and severity of extreme weather events such as hurricanes, wildfires, and floods. The…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings