Moody’s 2025 Ratings Manual: Redefining Transparency and Clarity in Credit Markets

Moody’s has unveiled its updated guide to investment grade rating symbols and definitions—a comprehensive reference that promises greater clarity in assessing credit risk in an ever‐evolving global financial landscape. Published as of January 2, 2025, the document details the evolution of Moody’s rating system—a system originally devised over a century ago—now expanded and refined to meet modern market demands.

A New Era in Credit Rating Methodologies

Moody’s long-standing reputation is built on a commitment to transparency and forward-looking analysis. With the 2025 Ratings Manual, the firm goes beyond a mere rebranding of symbols—it offers an entirely refreshed methodology that underscores ratings as dynamic, predictive tools rather than static snapshots of past performance.

Key enhancements include:

- Enhanced Forward-Looking Analytics:

The manual provides a detailed discussion on how macroeconomic trends and market stress scenarios now influence both long-term and short-term ratings. Advanced statistical models are introduced to capture the nuances of rating transitions, offering investors a more precise estimation of default probabilities and recovery rates. These models integrate historical data with current economic indicators to project future performance under a range of market conditions. - Dual Framework for Risk Assessment:

Emphasizing both long-term obligations (exceeding eleven months) and short-term liabilities (thirteen months or less), the guide outlines a dual framework that clearly differentiates between expected default frequency and the magnitude of potential losses. This bifurcated approach provides investors with a dual lens through which to assess the creditworthiness of entities under various time horizons.

Expanding the Spectrum of Symbols and Scales

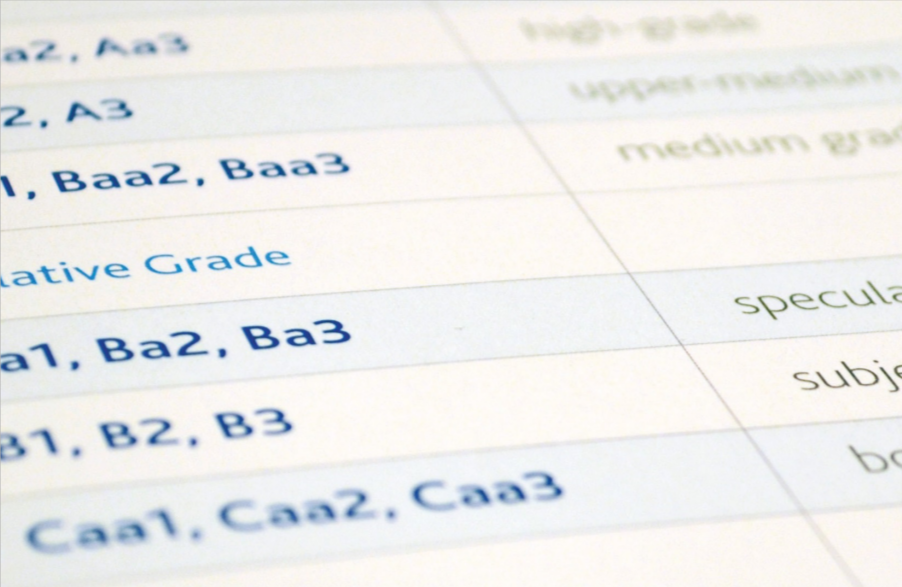

The updated manual dives deep into the intricacies of Moody’s iconic rating scales. While traditional long-term ratings range from Aaa—the pinnacle of credit quality—to C, which indicates severe distress or default, the new guide adds layers of granularity that address modern market complexities.

- Refined Modifiers and Special Indicators:

Numeric modifiers, such as Aa1, Aa2, and Aa3, have been recalibrated to offer finer distinctions between credit qualities. Additionally, specialized symbols like the “(sf)” tag for structured finance have been expanded. New modifiers now signal nuanced risks associated with emerging asset classes, ensuring that investors are aware of any structural or regulatory factors that might influence a rating’s reliability. - Diverse Product Coverage:

Beyond traditional corporate and municipal bonds, the manual now includes detailed coverage for deposit ratings, counterparty risk evaluations, corporate family ratings, and credit default swap ratings. This broadened scope reflects Moody’s effort to capture the full spectrum of modern financial instruments, acknowledging that today’s markets demand a more inclusive approach to credit risk assessment. - Deepening ESG and Climate Integration:

Perhaps the most notable addition is the expanded treatment of environmental, social, and governance (ESG) factors. In an era where sustainability and climate risk are central to investment decisions, Moody’s has dedicated significant portions of the manual to:- Net Zero Assessments and Carbon Transition Indicators: These tools help gauge how companies are managing the transition to a low-carbon economy.

- Emerging Climate Risk Modifiers: A new “Climate Risk Modifier” suffix has been introduced. This symbol alerts investors to the potential volatility arising from regulatory shifts and environmental policy changes, ensuring that sustainability considerations are woven into the very fabric of credit analysis.

Beyond Ratings: Supplementary Tools for the Modern Investor

The 2025 Ratings Manual is not solely about credit symbols—it also offers a suite of supplementary tools designed to enhance the investment decision-making process. These additional services underscore Moody’s commitment to providing a holistic view of credit risk.

- Fund and Manager Assessments:

Investors now have access to detailed evaluations of bond funds, equity funds, and even the operational quality of asset managers. These assessments provide a deeper look into the managerial competencies that can influence fund performance, giving investors another layer of insight when comparing investment vehicles. - Structured Finance and Liquidity Evaluations:

The complex realm of securitizations is addressed with new tools such as Structured Credit Assessments (SCAs) and Speculative Grade Liquidity Ratings. These evaluations offer a closer look at cash flow vulnerabilities and liquidity constraints, which are critical in today’s market environment where the interplay of various risk factors can significantly affect asset performance. - Innovative Analytical Metrics:

The manual introduces advanced metrics like Baseline Credit Assessments and Q-scores. These innovative tools are designed to dissect the credit profile of sub-sovereign entities and other nontraditional instruments with a level of granularity that was previously unattainable. By combining these metrics with scenario analysis tools, Moody’s provides a forward-looking view that helps investors anticipate shifts in market dynamics. - Predictive Models for Rating Transitions:

One of the standout features of the new manual is its emphasis on rating transitions. Moody’s now provides detailed projections of how ratings might evolve over time, backed by robust predictive analytics. This enhancement not only aids in risk management but also empowers investors to make portfolio adjustments well ahead of market shifts.

Navigating the ESG and Climate Frontier

The integration of ESG and climate factors in the updated manual marks a significant turning point in credit analysis. Recognizing that traditional financial metrics are no longer sufficient, Moody’s has laid out a comprehensive framework to evaluate sustainability risks:

- Quantifying Sustainability with a “Green Transition Score”:

Investors are introduced to a new scoring system that quantifies a company’s commitment to sustainable practices. This score takes into account a range of factors—from carbon footprint and energy efficiency to governance practices and social responsibility—providing a clear metric for comparing firms on a sustainability basis. - Scenario-Based Climate Stress Testing:

The manual outlines methodologies for assessing how companies might perform under various climate-related stress scenarios. This forward-looking analysis is critical as regulatory pressures and environmental challenges increasingly impact corporate performance. By simulating potential outcomes, investors can better understand the risks associated with climate change and adjust their strategies accordingly. - Enhanced Disclosure Requirements:

In line with global trends towards greater corporate transparency, Moody’s now recommends a more rigorous disclosure of ESG-related risks. This move is expected to drive more consistent reporting standards across industries, helping investors make more informed comparisons and investment decisions.

Implications for Global Markets and Investment Strategies

The expanded scope of the 2025 Ratings Manual has significant implications for both global markets and individual investment strategies. With a richer array of analytical tools and a deeper integration of modern risk factors, investors are now equipped with a more comprehensive roadmap for navigating volatile markets.

- Enhanced Comparability Across Markets:

The refined rating scales and detailed product coverage allow for more accurate cross-comparisons between different issuers, instruments, and geographic regions. This is particularly important as global markets become more interconnected and traditional boundaries blur. - Driving Informed Decision-Making:

By offering a clearer picture of both traditional credit risks and emerging threats—such as those posed by climate change—Moody’s manual enables investors to make decisions based on a holistic view of risk. This is a critical advantage in an era marked by rapid technological changes, regulatory shifts, and unpredictable economic cycles. - Shaping Portfolio Resilience:

The document’s predictive models and advanced analytics offer investors actionable insights that can be incorporated into dynamic risk management frameworks. Whether it’s through better anticipation of rating transitions or by understanding the financial implications of ESG risks, the updated guide is set to play a pivotal role in shaping more resilient portfolios. - Industry Reactions and Market Outlook:

Early feedback from market participants suggests that Moody’s 2025 update is already influencing asset pricing and credit spreads. Experts believe that the improved transparency and predictive capabilities will reduce information asymmetry in the credit markets, ultimately leading to more efficient capital allocation and enhanced market stability.

Looking Ahead: The Future of Credit Risk Assessment

As the financial landscape continues to evolve, Moody’s latest manual stands as a testament to the need for continuous innovation in risk assessment. The integration of traditional rating methodologies with cutting-edge analytics and sustainability metrics signals a future where credit ratings are more than mere labels—they are comprehensive indicators of both current performance and future potential.

- Bridging Historical Methodologies with Contemporary Needs:

The 2025 Ratings Manual successfully bridges the gap between time-tested credit analysis and the dynamic challenges of today’s market. By incorporating both legacy systems and modern innovations, Moody’s ensures that its ratings remain relevant in an era defined by rapid change. - Empowering Investors with Actionable Insights:

For investors, the updated guide is more than an academic exercise—it is a practical tool that provides the clarity needed to make informed decisions in a complex environment. Whether assessing the creditworthiness of a sovereign issuer or evaluating the sustainability of a multinational corporation, the manual offers a roadmap to navigate uncertainties and capitalize on opportunities. - A Call to Action for the Investment Community:

In today’s volatile and interconnected global markets, staying ahead of risk is paramount. Moody’s 2025 Ratings Manual challenges investors to look beyond traditional metrics and consider a wider array of factors that influence credit risk. It is an essential resource for anyone looking to build a robust, future-ready investment strategy.

Conclusion

Moody’s 2025 Ratings Manual sets a new benchmark for transparency and analytical depth in credit risk assessment. By expanding its rating framework to encompass both established and emerging risk factors—including enhanced forward-looking analytics, detailed ESG and climate considerations, and innovative supplementary tools—the guide provides investors with an indispensable resource for navigating today’s complex financial landscape. As global markets continue to evolve, this manual will undoubtedly serve as a critical reference point for informed decision-making and strategic portfolio management.

Investors and market participants are encouraged to review the full document closely and integrate its insights into their risk management processes. With Moody’s latest refresh, the future of credit analysis looks not only more comprehensive but also more attuned to the demands of a rapidly changing world.

Download the Full Moodys Ratings Report