The Problem Every Successful Residential Investor Eventually Faces

There’s a moment in every residential or multifamily investor’s career where the math starts working against you. Not the acquisition math. You’ve been good at that for years. The operational math. The management math. The "it’s 2 AM and a pipe burst in Unit 14" math.

You’ve built real equity. Maybe it’s a portfolio of single-family rentals you’ve accumulated over fifteen years. Maybe it’s an 80-unit apartment complex you repositioned and stabilized. Maybe it’s a collection of small multifamily buildings that collectively throw off solid cash flow but demand constant attention. Whatever the asset, you’ve reached a point where the property has appreciated significantly, your depreciation has been largely exhausted, and you’re staring at a capital gains event that could cost you hundreds of thousands of dollars, or more, if you sell without a plan.

This is exactly the scenario that Section 1031 of the Internal Revenue Code was designed to address. And for a growing number of residential and multifamily investors, the replacement property of choice isn’t another apartment building. It’s a single-tenant, triple-net leased property occupied by an investment-grade corporation.

The reasons for this shift go far beyond tax deferral. They touch on quality of life, predictability of income, the mechanics of how net operating income actually works in different asset classes, and the compounding tax advantages that come with direct ownership of NNN real estate.

What a 1031 Exchange Actually Accomplishes

Before getting into the specifics of triple-net properties, it’s worth grounding the conversation in what a 1031 exchange does and doesn’t do.

When you sell an investment property that has appreciated in value, you owe capital gains tax on the difference between your adjusted basis and the sale price. Depending on how long you’ve held the asset, how much depreciation you’ve taken, and your income level, the combined federal and state tax hit can easily reach 30% to 40% of your gain. On a property that’s appreciated by $2 million, that’s $600,000 to $800,000 that disappears to taxes instead of being redeployed into income-producing real estate.

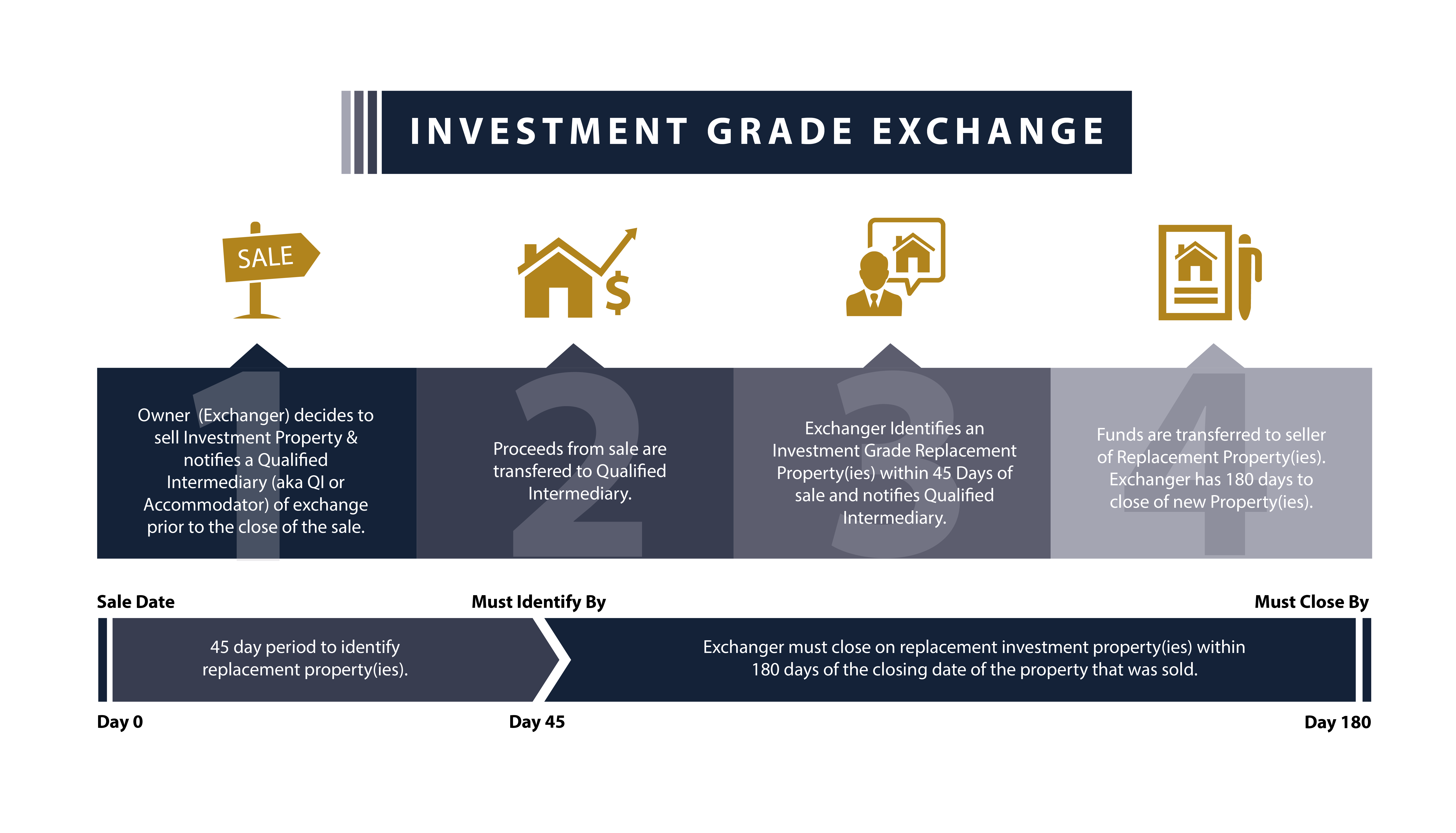

A 1031 exchange allows you to defer that entire tax obligation by reinvesting the proceeds into like-kind replacement property. The rules are specific. You have 45 days to identify replacement properties and 180 days to close. But the definition of "like-kind" is broad. Any real property held for investment or business use qualifies. A seller of a 60-unit apartment complex in Dallas can exchange into a single-tenant pharmacy in Orlando. A seller of a duplex portfolio in Denver can exchange into a quick-service restaurant property in Phoenix.

The key word is "defer." You’re not eliminating the tax. You’re pushing it forward, preserving your full equity to generate income in the replacement property. And if you continue exchanging throughout your lifetime, the deferred gain can ultimately receive a stepped-up basis at death, effectively eliminating the tax permanently for your heirs.

That’s a powerful wealth preservation tool on its own. But the real question is what you exchange into, and that’s where triple-net properties fundamentally change the equation.

True NOI vs. Variable NOI: The Core Financial Distinction

This is the concept that clicks for almost every multifamily investor the first time they really examine it, and it’s worth spending time on because it changes how you think about cash flow entirely.

In multifamily and residential real estate, your net operating income is a variable number. It’s the result of gross potential rent, minus vacancy, minus credit loss, minus a long list of operating expenses that you as the owner are responsible for. Those expenses include property taxes, insurance, utilities in some cases, property management fees, maintenance and repairs, landscaping, pest control, common area upkeep, unit turnover costs, legal and eviction expenses, marketing costs for vacant units, and capital reserves for items like roofs, HVAC systems, parking lots, and plumbing.

Every one of those line items is subject to change, and most of them trend upward over time. Property taxes get reassessed. Insurance premiums spike after a bad storm season. A boiler replacement that you budgeted at $40,000 comes in at $65,000. Two tenants stop paying in the same quarter and the eviction process takes four months. Your property manager raises their fee from 6% to 8%. None of these events are unusual. They’re the normal operating reality of residential and multifamily ownership.

The result is that your actual NOI in any given year can vary significantly from your projection. You might underwrite a property at a 6.5% cap rate based on pro forma NOI, but after accounting for real-world operating expenses, vacancy, and capital needs, your effective return might be closer to 5%, or worse in a bad year. The NOI on your financial statements is always an estimate, always subject to revision, and always dependent on dozens of variables you can influence but never fully control.

Triple-net properties work on a fundamentally different model. In a true NNN lease, the tenant is contractually responsible for all operating expenses associated with the property. That means the tenant pays the property taxes. The tenant pays the insurance. The tenant pays for all maintenance, repairs, and capital expenditures, including the roof, structure, parking lot, and building systems. The landlord’s only responsibility, in most cases, is the mortgage payment.

What this means in practice is that your NOI is not a variable. It is a contractual number. It is the rent specified in the lease, period. There is no vacancy to budget for because you have a single tenant under a long-term lease. There are no operating expenses to deduct because the tenant bears them all. There are no capital reserves to fund because the tenant is responsible for maintaining the property. Your rent check arrives on the first of the month, and that rent check is your NOI.

This is not a minor distinction. It is the fundamental difference between owning a business (which is what multifamily effectively is) and owning a financial instrument backed by real estate and a corporate credit obligation (which is what NNN effectively is). The income from a NNN property behaves more like a bond coupon than a rental income stream, except it’s backed by real property you own, it grows through contractual rent escalations, and it qualifies for real estate tax benefits that bonds never will.

For investors who have spent years managing the gap between projected and actual NOI in their multifamily portfolios, this shift from variable to contractual cash flow is often the single most compelling reason to exchange into NNN.

The Direct Ownership Advantage: Why You Want 100% of the Property

When residential and multifamily investors begin exploring the NNN space, they often encounter several different ownership structures: Delaware Statutory Trusts (DSTs), tenancy-in-common arrangements (TICs), real estate funds, and direct ownership. Each has a role, but direct ownership offers advantages that the others simply cannot replicate.

When you own a NNN property outright, meaning you hold title to 100% of the property, you control every aspect of the investment. You choose when to refinance. You choose when to sell. You choose whether to exchange again or harvest the gain. You negotiate the lease terms directly. And critically, you capture 100% of the tax benefits.

This last point is particularly significant for 1031 exchange investors. When you acquire a property through a direct purchase, you can immediately commission a cost segregation study that reclassifies certain building components into shorter depreciation categories. Five-year, seven-year, and fifteen-year property instead of the standard 39-year schedule for commercial real estate. Under current tax law, these reclassified components may qualify for bonus depreciation, allowing you to accelerate a substantial portion of the building’s depreciable value into the first year of ownership.

The practical effect is remarkable. You defer your capital gains through the 1031 exchange. Then you shelter a significant portion of the rental income from the replacement property through accelerated depreciation. The combination means you’re not only avoiding the tax on your gain. You may also be reducing or eliminating the tax on your new income stream, at least in the early years of ownership.

In a DST or fund structure, these benefits are diluted across all investors, and you have no control over whether or when a cost segregation study is performed. In a direct ownership structure, you make that call yourself, and you reap the full benefit.

The Asset Classes Worth Owning in 2026

Not all triple-net properties are created equal, and the quality of the tenant matters enormously. An investment-grade tenant, generally defined as a company with a credit rating of BBB- or better from S&P, or Baa3 or better from Moody’s, provides a fundamentally different risk profile than a franchisee-operated location or a regional tenant with limited financial transparency.

That said, credit ratings are not static, and investors need to be discerning about which tenants and sectors represent genuine strength going forward. The NNN landscape in 2026 looks meaningfully different from even a few years ago. Some tenants that were once considered reliable are now showing real operational and financial stress, and smart investors are paying close attention to the operating fundamentals behind the lease, not just the name on the building.

Here are the sectors and tenant profiles that represent the strongest opportunities today.

Healthcare

Healthcare is arguably the most compelling sector in NNN investing right now, and the tailwinds are structural rather than cyclical. An aging Baby Boomer population is driving unprecedented demand for outpatient services, dialysis, dental care, veterinary medicine, urgent care, and specialty clinics. These are essential services that patients cannot defer indefinitely, which insulates the tenant’s revenue stream from economic downturns.

The tenants worth targeting include large dialysis operators like DaVita and Fresenius, which operate under mandatory-use models driven by end-stage renal disease prevalence. Dental service organizations that operate multi-location practices under long-term leases. Veterinary hospital groups like VCA (owned by Mars, Inc.) that benefit from the secular growth in pet ownership and pet healthcare spending. Urgent care and outpatient surgery operators that are capturing volume migrating away from expensive hospital settings.

Healthcare properties also carry a practical advantage that many investors overlook: the cost of tenant relocation is extraordinarily high. Medical buildouts are expensive and highly specialized. A dialysis center or surgical suite cannot simply move to a cheaper location without incurring hundreds of thousands of dollars in construction costs and months of downtime. This creates a powerful economic incentive for the tenant to renew, which translates directly into lower re-leasing risk for the landlord.

Lease terms in healthcare NNN typically run 10 to 20 years with annual rent escalations of 1.5% to 3%, and cap rates generally range from 5.5% to 7.0% depending on the tenant credit, location, and remaining lease term.

Automotive Service

The automotive service sector has quietly become one of the most reliable corners of the NNN market. Tenants include Valvoline, Take 5 Oil Change, Caliber Collision, Maaco, Discount Tire, and a growing number of national tire and service chains that are consolidating fragmented local markets.

The investment thesis here is straightforward. Vehicles require maintenance regardless of economic conditions. Oil changes, tire replacements, brake work, and collision repair are non-discretionary expenses for the 280 million registered vehicles on American roads. These properties are purpose-built. A quick-lube facility or collision center cannot easily be repurposed, which means the tenant has a strong incentive to remain in place and the property itself has limited alternative use, keeping replacement tenant risk manageable for the specific operators in these spaces.

Most automotive NNN leases run 15 to 20 years with corporate guarantees and absolute NNN structures. Cap rates typically range from 5.0% to 6.5%.

Quick Service Restaurants

QSR is one of the most liquid and actively traded sectors in NNN. The brand names are household names: McDonald’s, Chick-fil-A, Raising Cane’s, Wingstop, Dutch Bros, Starbucks, and Taco Bell among them.

The key distinction in QSR is between corporate-guaranteed leases and franchisee-operated leases. A McDonald’s ground lease with a corporate guarantee is essentially a bond alternative. You own the land, the tenant owns or leases the building, and the credit behind the lease is one of the strongest in the world. Cap rates for these assets can compress below 4.5%, reflecting the near-zero risk profile.

Franchisee-operated locations offer a different value proposition. The credit is typically the individual franchisee or a multi-unit operator rather than the parent corporation, which means higher yields, often in the 5.5% to 6.5% range, but also more diligence required around the operator’s financial strength, unit-level performance, and lease guarantees.

Ground lease structures in QSR deserve special mention. When you own only the land beneath a restaurant, your exposure to building maintenance, roof, structure, and systems is literally zero. The tenant is responsible for everything above grade. It’s the most passive form of real estate ownership that exists, and the income is backed by a business that generates high revenue per square foot and has strong incentives to remain at the location.

Dollar Stores and Essential Retail

Dollar General, Dollar Tree, and similar essential retailers represent the high-volume, lower-price-point end of the NNN spectrum. These properties are typically located in rural or secondary markets where the tenant serves as the primary or only retailer for the surrounding population. Construction costs are low, lease terms run 10 to 15 years, and cap rates are generally in the 6.0% to 7.5% range.

The investment case rests on the essential nature of the goods sold (household staples, food, cleaning supplies, and personal care items) and the tenant’s dominant market position in underserved areas. Dollar General in particular has been aggressively expanding and upgrading its store base, and properties with newer construction and longer remaining lease terms command premium pricing.

These are not glamorous assets, but they are workhorses. For 1031 investors looking to maximize yield while maintaining a creditworthy tenant, dollar store NNN can be an excellent fit within a broader portfolio.

Banking and Financial Services

Bank branches leased to institutions like Chase, Bank of America, and major regional credit unions offer some of the strongest credit profiles available in NNN. These tenants are among the most financially regulated entities in the economy, and their real estate commitments are backed by balance sheets measured in the hundreds of billions or trillions of dollars.

Bank branch properties are typically located on high-visibility corner parcels in established commercial corridors, which means the underlying real estate carries significant residual value even beyond the lease term. Lease terms commonly run 10 to 20 years, and cap rates range from 4.5% to 6.0% depending on the institution and market.

Convenience and Fuel

Single-tenant convenience stores and fuel stations leased to operators like 7-Eleven, Wawa, Buc-ee’s, Circle K, and QuikTrip are high-traffic, essential-service properties. These assets perform well across economic cycles and often feature 20-year absolute NNN leases with strong corporate or franchise guarantees. Cap rates typically fall in the 4.5% to 6.0% range for the strongest operators.

The Freest Asset Class in Real Estate

We often describe NNN investing as the "free" asset class. Not because it costs nothing, but because it frees you. It frees you from tenant management. It frees you from maintenance emergencies. It frees you from the operational grind that defines residential and multifamily ownership. And when structured through a 1031 exchange, it frees you from the immediate tax consequences of selling an appreciated asset.

What you’re left with is pure, passive, investment-grade income. Backed by a nationally recognized tenant. Protected by a long-term lease. Growing predictably through contractual rent escalations. And sheltered by depreciation benefits that you control as the direct owner.

That’s not just a good investment. That’s investment-grade passive income.

Interested in Exploring Investment-Grade NNN Opportunities?

We source both on-market and off-market triple-net properties nationally, ranging from $1M to $20M. Whether you’re mid-exchange or planning ahead, our team can match you with the right asset for your goals.

Email team@investmentgrade.com and let us know:

- Your desired cap rate range

- Your target price range

- Whether you’re currently in a 1031 exchange (and your timeline)

We’ll respond within 24 hours with curated opportunities that fit your criteria.

Can I 1031 exchange a multifamily property into a triple net lease property?

Yes. The IRS defines like-kind broadly for real property, so any investment real estate can be exchanged for any other investment real estate. A seller of an apartment complex can exchange into a single-tenant NNN property leased to an investment grade corporation. You have 45 days to identify replacement properties and 180 days to close the transaction.

What is the difference between variable NOI and contractual NOI in NNN leases?

In multifamily, your net operating income fluctuates with vacancy, repairs, insurance hikes, and dozens of other expenses you absorb as the owner. In a true triple net lease, the tenant pays all property taxes, insurance, and maintenance, so your NOI equals the contractual rent specified in the lease. There is no gap between projected and actual income.

Why is direct NNN ownership better than a DST for a 1031 exchange?

Direct ownership gives you 100% of the tax benefits, including the ability to commission your own cost segregation study and capture accelerated depreciation in year one. You also control refinancing, sale timing, and lease negotiations. In a DST or fund, those benefits are diluted across all investors and the sponsor controls key decisions.

Which NNN tenant sectors are strongest for 1031 exchange buyers in 2026?

Healthcare leads the pack with structural demand from an aging population, followed by automotive service chains with non-discretionary maintenance revenue, quick-service restaurants with corporate-guaranteed ground leases, essential retail like Dollar General, investment grade bank branches, and high-traffic convenience and fuel operators. Each sector offers different cap rate ranges and lease structures.

How does bonus depreciation work when you 1031 exchange into a NNN property?

After closing on your replacement property, you commission a cost segregation study that reclassifies building components into shorter depreciation categories of five, seven, and fifteen years instead of the standard 39-year schedule. Under current law, these reclassified components may qualify for bonus depreciation, allowing you to shelter a substantial portion of rental income from taxes in the first year of ownership.

This article is for informational purposes only and does not constitute investment, tax, or legal advice. Investors should consult with qualified tax and legal professionals before executing a 1031 exchange or making any investment decision.