Investment Grade

Cap Rates

Cap rates—short for capitalization rates—offer a window into the true value and return potential of a commercial real estate asset. In this category, we unpack how these deceptively simple metrics shape perceptions of risk, stability, and long-term profitability. For investors focused on “investment grade” opportunities, understanding how cap rates intersect with creditworthy tenants, stable cash flows, and resilient property sectors is essential. While a cap rate is often expressed as a single percentage, it reflects a complex blend of factors: the property’s net operating income, the prevailing interest rate environment, the quality of the underlying lease agreements, and market sentiment about future growth.

Our articles delve into the nuanced role that cap rates play in signaling whether a property is truly aligned with “investment grade” standards. Low cap rates can indicate that the market perceives an asset as more stable, often one anchored by a top-tier tenant with an established credit rating and a reliably performing lease. Such properties typically draw parallels to investment grade bonds, where a stronger credit profile correlates to lower yields but greater certainty. Conversely, higher cap rates may suggest more volatility, the potential for elevated risk, or the need for more active management. By understanding these dynamics, you can better gauge whether a given asset matches your risk tolerance and strategic objectives.

We also explore the interplay between cap rates and various asset classes within commercial real estate, from multifamily developments and office properties to industrial warehouses and triple net lease (NNN) retail assets. Each sector faces its own set of market pressures and tenant expectations, which can shift cap rates over time. Geographical considerations further impact these metrics—prime urban centers with limited supply and strong demand often present lower cap rates, while emerging markets may offer higher cap rates yet require thorough due diligence and patience.

In addition, we examine how macroeconomic shifts influence cap rates. Rising interest rates, changes in inflation, regulatory shifts, and the broader capital market landscape all shape investor sentiment. By analyzing these factors, we help you anticipate when cap rates may compress or widen, offering insights into the timing of acquisitions, refinancing strategies, and portfolio adjustments.

For novice investors, our content breaks down the math behind cap rates and provides clear examples illustrating their application in real-world scenarios. For experienced market participants, we present advanced discussions on portfolio optimization, the comparison of cap rates across different property types, and insights into balancing yield with the peace of mind that comes from investing in quality, investment-grade real estate. Ultimately, our goal is to help you see cap rates not as a static figure, but as a dynamic tool—one that, when interpreted with context and care, can guide you toward smarter investments and more confident participation in the commercial real estate landscape.

-

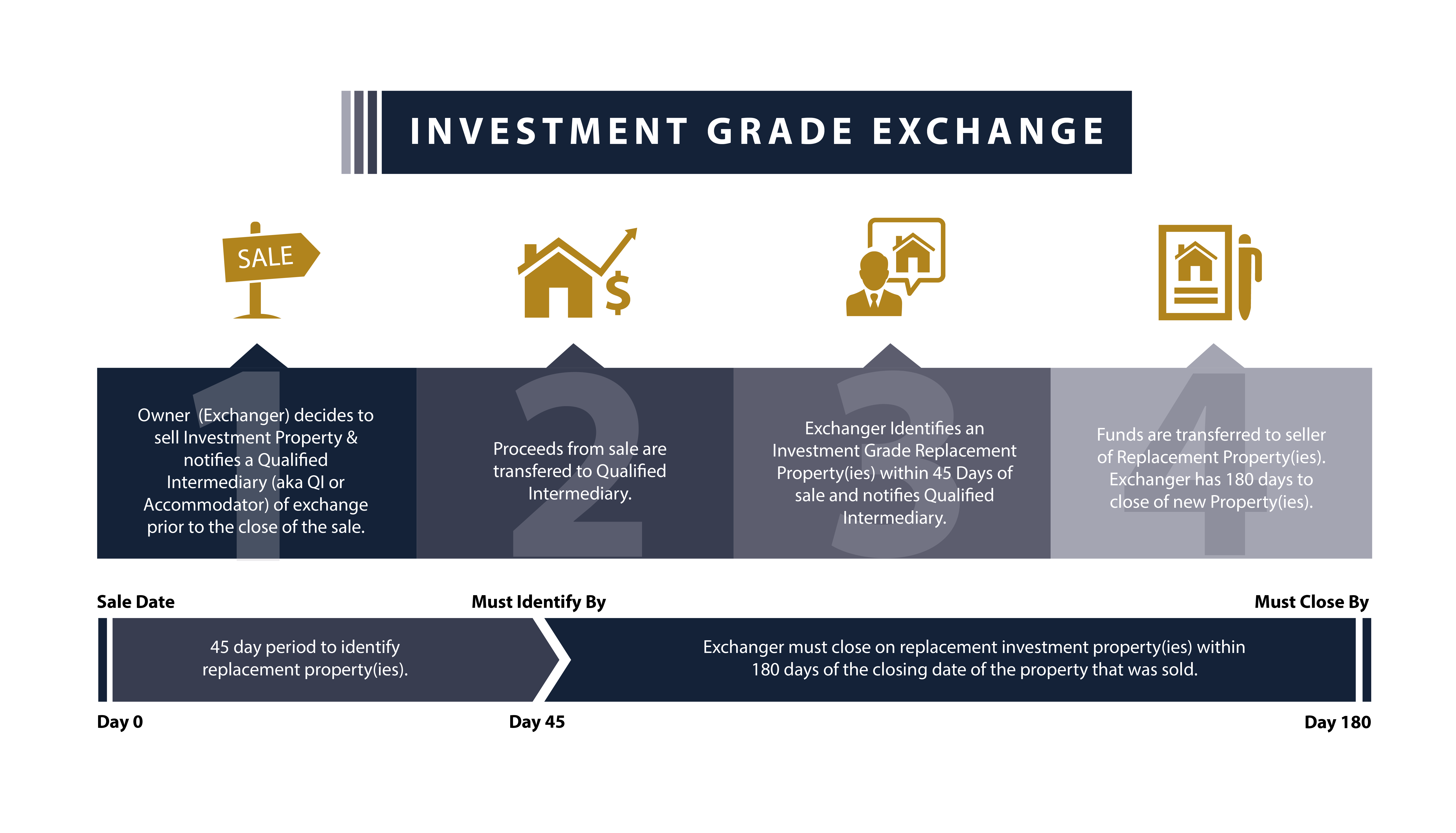

Investment Grade 1031 Exchange Market Trends

13th July 2025 | by the Investment Grade Team

The 1031 exchange market has undergone significant transformation over the past five years, reflecting broader shifts in commercial real estate dynamics and investor preferences. After achieving record transaction volumes during the post-pandemic boom of 2021-2022, activity moderated in 2023 as rising interest rates cooled the market. Despite this cyclical slowdown, fundamental investor interest in tax-deferred…

-

Investment Grade Auto NNN: A Guide to Acquiring Automotive Tenants

13th July 2025 | by the Investment Grade Team

The automotive sector has evolved into a vibrant niche within the triple-net (NNN) lease market. Auto parts retailers, service centers, dealerships, and rental companies all play a significant role in delivering essential services, from routine maintenance to complex repairs. These businesses, often operating from standalone buildings or pad sites with long-term leases, are especially attractive…

-

Investment Grade Dollar General: An In-Depth Analysis for Passive Income Investors

13th July 2025 | by the Investment Grade Team

Contributor: Eli Schultz Dollar General has become a cornerstone for many passive real estate investors, especially those seeking NNN (triple-net) leases backed by an investment grade tenant. With thousands of small-format stores across the country, this discount retail giant offers steady cash flows, minimal landlord obligations, and a resilient business model. This analysis dives deep…

-

Navigating the Future: 2025 Commercial Real Estate Outlook

13th July 2025 | by the Investment Grade Team

The commercial real estate market is on the cusp of transformation. Deloitte’s 2025 Commercial Real Estate Outlook presents a cautiously optimistic vision for the future of the sector—a vision supported by robust survey data, macroeconomic trends, and the rapid pace of technological adoption. In a market often defined by cycles of boom and bust, industry…

-

Impact of Interest Rate Cuts on Real Estate Cap Rates

13th July 2025 | by the Investment Grade Team

With the Federal Reserve implementing interest rate cuts, the real estate market is poised to see notable shifts in cap rates, particularly as long-term yields like the 10-year Treasury yield directly influence real estate investments. Cap rates, which represent the yield of a property based on its net operating income (NOI) and current market value,…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings