An Investment Grade Triple Net Lease combines the credit strength of top-tier corporate tenants with a lease structure that shifts property taxes, insurance, and maintenance obligations onto the tenant, delivering landlords a highly predictable income stream and built-in rent escalations. By focusing on tenants rated BBB– or higher, investors can mitigate downside risk, secure contractual rent growth, and benefit from tax-advantaged, largely return-of-capital income—making NNN leases a cornerstone of defensive real estate portfolios in today’s inflationary environment.

What is a triple net lease? A Net Lease is a lease arrangement where the tenant pays, in addition to base rent, property taxes, insurance, and maintenance costs. In a Triple Net (NNN) structure, these three “nets” are fully borne by the tenant, while the landlord enjoys net operating income (NOI) that excludes almost all variable property expenses. NNN leases typically include annual contractual rent escalators, providing investors with steady, predictable income growth and minimal landlord responsibilities.

Sale-leasebacks, a variant of the NNN model, allow companies to sell their real estate assets and immediately lease them back—unlocking capital without disrupting operations. The investable universe for U.S. and Canadian sale-leaseback transactions stands at nearly $11.8 trillion, yet annual volumes total only $41 billion—less than 1% of the overall market, highlighting the vast opportunity for net lease investors who can capitalize on this under-penetrated segment.

Tenants also derive material benefits under triple net leases:

- Longer leases with predictable increases: NNN agreements often run 10–25 years, with built-in rent escalators that hedge against inflation.

- Tax deductibility: Companies can fully deduct rent payments, including taxes and insurance, from their operating expenses.

- Operational continuity: Firms maintain full control of their facilities with no relocation risk and no need to secure new tenants.

- Capital optimization: By monetizing “hidden” real estate value, companies free up balance-sheet liquidity for core business investments.

Through periods of market stress—like the Great Recession and the COVID-19 pandemic—investment-grade net lease assets have consistently outperformed other property classes. During 2008–2010, net-leased IG properties saw NOI hold near or above pre-crisis levels, while industrial, office, and apartment sectors experienced significant drawdowns. Likewise, net lease portfolios maintained over 92% of pre-pandemic NOI through 2020, underscoring their recession-resistant profile.

At its core, the Net Lease Strategy is an income-driven approach that emphasizes tenant credit quality. With long-term contractual leases, investors aim to:

- Seek downside mitigation by choosing tenants with low default likelihood, even in downturns.

- Generate inflation-hedged cash flow via built-in rent bumps.

- Enjoy tax-advantaged returns, as a portion of distributions often qualifies as return of capital, deferring tax liability.

Leading Public Net Lease REITs Leveraging the Model

A number of publicly-traded REITs have built their platforms around the stability of investment-grade NNN leases. Here are some of the largest by market capitalization:

- Realty Income (NYSE: O): The “Monthly Dividend Company” owns over 15,600 properties across essential retail and service industries, delivering reliable monthly cash flows.

- W. P. Carey (NYSE: WPC): A diversified net lease REIT with 1,300+ properties, spanning industrial, office, and retail, known for its long-term lease structures.

- National Retail Properties (NYSE: NNN): Focused on single-tenant retail properties, NNN boasts a portfolio of over 3,000 locations with investment-grade tenants.

- STORE Capital (NYSE: STOR): Specializes in single-tenant operational real estate with NNN leases, emphasizing creditworthy corporate tenants in essential industries.

- Agree Realty (NYSE: ADC): Concentrates on retail net lease properties, with a monthly dividend and a portfolio that includes both investment-grade and growth-oriented tenants.

- Spirit Realty Capital (NYSE: SRC): Owns a broad mix of retail and service properties, leveraging long-term net leases for predictable income.

- Broadstone Net Lease (NYSE: BNL): Focuses on single-tenant net lease investments across the U.S., with a diversified base of high-credit occupants.

- Essential Properties Realty Trust (NYSE: EPRT): Targets essential services real estate, including medical clinics, fitness centers, and convenience stores under NNN leases.

- EPR Properties (NYSE: EPR): Though known for entertainment real estate, EPR also holds NNN lease assets in theaters and amusement parks.

- Global Net Lease (NYSE: GNL): Owns a diversified, mission-critical international portfolio of single-tenant NNN properties.

Top Private Equity Firms in Net Lease and Sale-Leaseback

Beyond REITs, major private equity and alternative asset managers are active in net lease and sale-leaseback transactions, often partnering with corporate tenants to unlock real estate value:

- Blue Owl Capital Inc. (NYSE: OWL): Through its Oak Street Real Estate platform, Blue Owl structures sale-leasebacks for corporate clients seeking to monetize real estate while retaining operational control.

- Brookfield Asset Management (NYSE: BAM): A global alternative asset manager with a real estate arm that executes large-scale net lease and sale-leaseback deals, including logistics and retail portfolios.

- Blackstone Inc. (NYSE: BX): The world’s largest alternative investment firm, Blackstone has executed numerous net lease and sale-leaseback transactions through its real estate divisions.

- KKR & Co. Inc. (NYSE: KKR): Combines private equity and credit strategies to finance sale-leasebacks and net lease acquisitions, tapping its deep lender and sponsor network.

- Apollo Global Management (NYSE: APO): Deploys capital across real estate credit and equity, offering tailored sale-leaseback financing and net lease investment vehicles.

- Oaktree Capital Management (NYSE: OAK): Specializes in distressed debt and structured financing, often acquiring NNN lease-backed receivables and providing rescue capital to corporate landlords.

Taken together, the success of these public REITs and private‑equity giants is powerful proof that the investment‑grade triple‑net model works at institutional scale. But the very same features that make NNN properties so attractive to billion‑dollar funds are available to individual investors—without the management layers and fee drag built into pooled vehicles. By assembling your own portfolio one property at a time, you maintain full control while capturing the core advantages that have driven consistent outperformance for the largest players in the space.

Why direct ownership of NNN assets deserves a place in your balance sheet

• Bond‑like, predictable cash flow — rent is secured by long‑term, investment‑grade credit and contractually escalates, creating a durable income stream that often rivals fixed‑income yields.

• Minimal day‑to‑day management — tenants handle taxes, insurance, and maintenance, freeing owners from capital‑expenditure surprises and time‑consuming oversight.

• Inflation protection — annual rent bumps (fixed or CPI‑linked) preserve purchasing power while many other income assets lose ground.

• Tax efficiency — you keep depreciation and cost‑segregation benefits, and a meaningful portion of cash flow is typically sheltered or treated as return of capital.

• Customized leverage — choose non‑recourse or limited‑recourse financing that matches your risk tolerance, often at spreads that sustain positive leverage.

• Estate‑planning flexibility — hold indefinitely, 1031 into larger assets, or pass properties to heirs on a stepped‑up basis—options a REIT share can’t replicate.

• No external fees or promotes — avoid acquisition, asset‑management, and performance fees charged by funds and enjoy the full benefit of property‑level returns.

The bottom line: the very strategy that underpins marquee names like Realty Income, Blue Owl, and Blackstone can be executed on a personal scale, delivering passive, inflation‑hedged income with institutional‑grade risk mitigation—minus the middlemen.

What is an investment grade triple net lease and how does it work?

An investment grade triple net (NNN) lease is a commercial real estate arrangement where a tenant rated BBB- or higher by major credit agencies pays base rent plus all property taxes, insurance, and maintenance costs. The landlord receives predictable net operating income with minimal management responsibility, typically under lease terms of 10 to 25 years with built-in annual rent escalations.

Why are NNN lease properties considered recession resistant?

During both the 2008 financial crisis and the COVID-19 pandemic, investment grade net lease properties maintained over 92% of pre-crisis net operating income while other commercial sectors saw significant drawdowns. The combination of long-term contractual leases and financially strong tenants insulates NNN investors from the revenue volatility that affects most other real estate asset classes.

What are the tax advantages of owning triple net lease properties directly?

Direct NNN ownership lets investors claim depreciation deductions and cost segregation benefits that reduce taxable income. A meaningful portion of cash flow is often classified as return of capital, deferring tax liability. Investors can also use 1031 exchanges to defer capital gains when selling, or pass properties to heirs on a stepped-up cost basis for estate planning.

How do NNN lease rent escalations protect against inflation?

Most investment grade triple net leases include contractual annual rent increases, either as fixed percentage bumps or adjustments tied to the Consumer Price Index (CPI). These built-in escalations ensure that rental income keeps pace with or exceeds inflation, preserving purchasing power in ways that fixed-income investments like bonds typically cannot.

What types of tenants are commonly found in investment grade NNN properties?

Common investment grade NNN tenants include national pharmacy chains, quick-service restaurant brands, dollar stores, auto parts retailers, medical office operators, and convenience fuel stations. These tenants provide essential goods and services with strong consumer demand, carry credit ratings of BBB- or higher, and typically sign long-term leases backed by corporate guarantees.

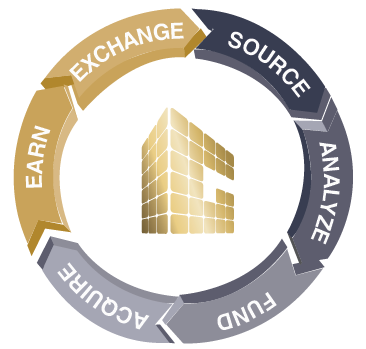

Building your own Essential Triple Net Portfolio starts with sourcing properties leased to investment-grade tenants—think leading retailers, pharmacies, and healthcare providers—under 10+ year NNN leases. Underwrite each asset for credit strength, lease term, and escalation clauses; diversify across sectors and regions to spread risk; and employ non-recourse financing calibrated to maintain healthy yield spreads. Partnering with experienced net lease brokers and asset managers can streamline deal sourcing, due diligence, and tenant negotiations as you scale from a handful of properties to a fully diversified 10–20 asset portfolio.

Ready to get started? Investment Grade Income Property specializes in sourcing off-market NNN deals, underwriting tenant credit, and arranging tailored financing for portfolios encompassing 180+ investment-grade credit tenants under long-term leases. Contact us today to explore how direct ownership of triple net properties can enhance your yield, protect your capital, and provide durable income for years to come. team@investmentgrade.com