After three years of historic underperformance, the publicly traded REIT universe is beginning to find its footing again. Entering 2025, REITs had accumulated a performance deficit of over 45 percentage points relative to the S&P 500—one of the largest gaps in modern market history. This valuation disconnect was driven not by failing fundamentals, but by macroeconomic pressures: a rapidly rising rate environment, volatile capital markets, and investor preference for growth and technology over yield and stability. As Treasury yields reached the highest levels in two decades, income-oriented assets like REITs faced a multi-year headwind that severely compressed earnings multiples.

But the winds appear to be shifting. Since mid-January, the FTSE Nareit Equity REIT Index has begun to outperform the broader market, reversing part of the gap. While the S&P 500 declined by 5.8% in the first quarter of 2025, REITs held up comparatively well, aided by the easing of interest rates and inflation concerns. This modest recovery comes even as REITs continue to trade at a wide discount to the S&P 500 on a P/FFO (price-to-funds-from-operations) basis—well below historical averages. In short, the real estate sector is showing signs of bottoming, and for the first time in years, some of the most challenged subsectors are flashing early indicators of stabilization.

Largely immune to direct trade and tariff risks, REITs are benefiting from pockets of sector-specific strength that cut against the broader economic narrative. Demand for multifamily housing remains strong in many regions, with single-family rental operators noting a rebound in pricing power. Travel demand, while moderating from its peak, continues to support hotel performance above 2019 levels. Industrial and logistics REITs have posted record leasing numbers thanks to sustained e-commerce trends and the reshoring of supply chains. Meanwhile, data center REITs are capitalizing on the AI boom, offsetting reduced activity from hyperscale tenants with robust demand from enterprise customers and GPU-intensive use cases.

However, not all sectors are benefiting equally. Office REITs continue to grapple with structural challenges from hybrid work and negative net absorption in major markets. Storage REITs are seeing declining street rates as turnover in the housing market remains near generational lows. And while strip centers and malls have enjoyed strong occupancy and leasing spreads in recent years, a recent uptick in store closures and retail bankruptcies has injected uncertainty into the outlook for 2025.

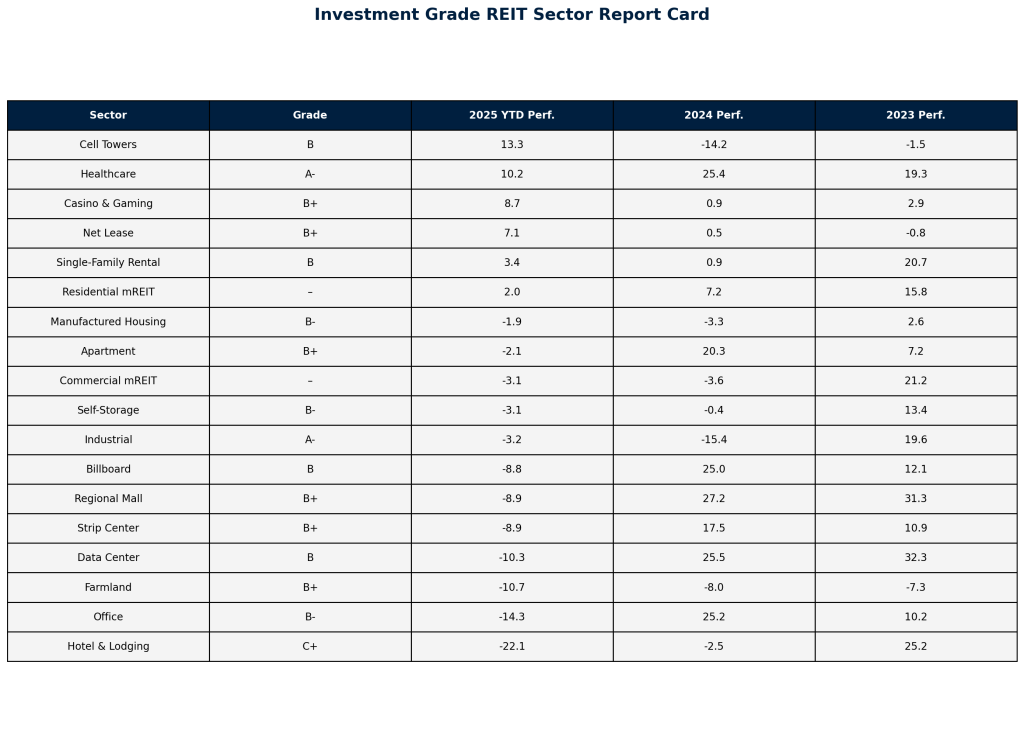

To help investors navigate this complex landscape, the Investment Grade REIT Sector Report Card offers a sector-by-sector breakdown of performance, earnings trends, and forward-looking outlooks. Each major REIT sector has been assigned a grade based on recent earnings results, year-to-date performance, long-term fundamentals, and macro sensitivity. This grading system reflects the intersection of valuation, momentum, and risk, allowing investors to identify where REITs are merely surviving—and where they are truly making the grade.

Below, we detail the current standing of each major property sector heading into the second quarter of 2025.

Industrial (Grade: A-)

Industrial REITs have remained one of the most stable and high-performing property sectors entering 2025. Following a challenging 2024 in which the sector returned -15.4%, the first quarter of 2025 has shown signs of stabilization, with only a modest -3.2% YTD decline. Sector leaders like Prologis signed over 58M square feet of leases in Q1, nearly matching record volumes from late 2024. EastGroup and First Industrial both delivered strong rent spreads (42% YoY for First Industrial), while maintaining robust outlooks.

Despite macro tariff concerns, the industrial sector has benefitted from reshoring trends and resilient e-commerce growth. Leasing pipelines remain healthy, and supply growth has moderated in key markets. Combined with strong balance sheets and manageable debt loads, the industrial REIT sector continues to demonstrate long-term earnings power.

Healthcare (Grade: A-)

Healthcare REITs, particularly those in senior housing and skilled nursing, continued to shine into early 2025. The sector returned 10.2% YTD, following a robust 25.4% in 2024. According to NIC data, senior housing occupancy climbed for the 15th straight quarter, hitting 87.4%, while skilled nursing reached 85.9%. Rent growth in both subsegments remained above 3.5%.

Supply growth in the space is at its lowest level since 2010, and tenant health has steadily improved thanks to COLA adjustments and Medicare/Medicaid reimbursements. While medical office buildings (MOBs) face tighter margins, strong leasing demand from outpatient facilities supports future growth. The sector’s consistent performance and macro tailwinds keep it among the highest-graded in our report.

Retail (Grade: B+)

Retail REITs, encompassing strip centers and malls, continue to benefit from low new construction and a surprisingly resilient consumer. Strip centers posted -8.9% YTD but had a strong 2024 at +17.5%, while regional malls, after a record +27.2% in 2024, have corrected -8.9% in early 2025. Despite headline store closures, occupancy and rent spreads remain healthy.

Coresight Research expects 15,000 store closures in 2025—yet these have been concentrated in lower-tier tenants. Leading REITs with grocery-anchored or luxury-anchored centers remain well-positioned. Leasing spreads are holding up, and balance sheets have improved. These dynamics, combined with operational discipline, support a continued B+ rating.

Residential (Grade: B+)

The residential sector, including both apartment and single-family rental REITs, is seeing improving fundamentals after a 2023-2024 supply glut. Apartments returned -2.1% YTD, moderating from +20.3% in 2024. Q1 absorption topped 138,000 units, exceeding deliveries, with occupancy now at 95%. Rent growth is modest but steady, in the 2.3% range.

Single-family rental REITs have also shown resilience with a 3.4% YTD return. Sunbelt markets have lagged, while coastal and Midwest regions see stronger pricing. Operational cost pressures remain, especially on insurance, but new investment opportunities may emerge from distressed private landlords. On net, the sector holds its B+ grade.

Net Lease (Grade: B+)

Net lease REITs returned +7.1% YTD, rebounding from flat performance in 2024. Interest rate stabilization has supported improved investment spreads, while acquisition volume has begun to pick up. REITs like Agree Realty and Alpine Income raised guidance in Q1.

This sector benefits from long lease durations, minimal capex, and investment-grade tenant exposure. Although still sensitive to interest rate moves, net lease REITs are well-positioned for consistent AFFO growth, sustaining their B+ grade.

Casino & Gaming (Grade: B+)

Casino REITs delivered a strong 8.7% YTD return in 2025, after a quiet 0.9% in 2024. VICI and GLPI benefit from long-term triple-net master leases with major operators like Caesars and MGM. Their income streams are stable and inflation-protected.

The sector has minimal exposure to development risk and faces limited competition. Cap rates remain attractive, and operators have shown improved coverage ratios. Their predictable cash flows and asset durability support the B+ rating.

Farmland (Grade: B+)

Farmland REITs are among the most defensive plays, offering inflation protection and income from long-term leases. Despite underperformance in 2025 YTD (-10.7%) and negative 2024 returns, the fundamentals of farmland—scarcity, demand for food, and biofuel growth—remain intact.

With little new supply and growing institutional interest in agricultural land, this niche sector deserves its B+ due to long-term upside and portfolio diversification benefits.

Data Centers (Grade: B)

Data center REITs are seeing a bifurcated recovery. While some hyperscalers paused leasing, AI-driven demand has surged. Digital Realty reported $242M in bookings in Q1—its third-highest quarter ever—with two-thirds tied to AI tenants. Rent spreads and backlog hit new highs.

Yet the sector is highly capital-intensive and sensitive to rate and tech-cycle volatility. The -10.3% YTD performance, despite strong leasing, reflects investor caution. With strong long-term tailwinds, the B grade holds.

Cell Towers (Grade: B)

After two years of declines, cell towers have rebounded sharply with a 13.3% YTD gain. Macro tower activity is resuming as 5G investments return. Fixed wireless and rural broadband continue to drive demand.

However, Starlink’s satellite expansion adds competitive pressure, and domestic carrier CapEx is still recovering. Organic growth is improving, but valuation remains tied to rate sentiment. We maintain a B rating based on improving trends.

Billboards (Grade: B)

Billboard REITs like Lamar are benefiting from a full recovery in out-of-home advertising. Digital conversion and urban migration trends support higher CPMs and long-term lease renewals. The sector delivered a 25% return in 2024 but is down -8.8% YTD.

Though niche, the sector offers attractive cash flows and inflation-linked lease structures. With few competitors and a dominant market share, billboard REITs retain their B rating.

Office (Grade: B-)

Office REITs remain deeply challenged. After a 25.2% gain in 2024 from a low base, the sector is down -14.3% in 2025 YTD. JLL reports Q1 leasing of 50.4M SF—up 15% YoY—but net absorption was negative (-8.1M SF), driven by large government exits.

Conversions and asset sales are beginning to shrink oversupply, and select Sunbelt and boutique office assets remain resilient. Still, structural demand shifts require caution. We affirm the B- grade as recovery remains uneven.

Storage (Grade: B-)

Storage REITs delivered a -3.1% YTD return after flat results in 2024. Street rate declines persist for new customers, while move-out rates remain low. Operators are leaning on existing tenant increases and expense control.

Supply pressures are beginning to ease, but housing turnover remains sluggish. Without a rebound in migration or home sales, upside is limited. The sector holds a B- grade for now.

Manufactured Housing (Grade: B-)

Despite historical resilience, manufactured housing REITs have struggled recently. YTD returns are -1.9%, following -3.3% in 2024. While demand for affordable housing remains high, insurance costs and rent control legislation create headwinds.

Operators are cautious in new development, and tenant turnover is minimal. Without new catalysts, the sector maintains a B- as it navigates regulatory and expense pressure.

Hotel & Lodging (Grade: C+)

Hotels remain the most economically sensitive REIT sector. After -2.5% in 2024, the sector has fallen -22.1% YTD. STR reports RevPAR still exceeds 2019 levels, but occupancy growth is flattening.

Operator guidance has trended lower, and Wall Street remains skeptical despite solid TSA throughput data. With inconsistent FFO trends and rate sensitivity, hotels retain the lowest grade on this report card: C+.

Which REIT sectors received the highest investment grade ratings in 2025?

Why are REITs beginning to outperform the broader market in 2025?

How are net lease REITs performing relative to other REIT sectors?

What REIT sectors face the biggest challenges heading into late 2025?

Are data center REITs a good investment despite AI demand growth?