Investment Grade

Insurance

Insurance Ratings: The Foundation of Financial Stability

Insurance ratings are critical benchmarks that reflect the financial health and claims-paying ability of insurance providers. Assigned by major agencies like A.M. Best, Moody’s, and Standard & Poor’s, these ratings serve as vital indicators for policyholders, investors, and regulators, signaling the capacity of insurers to meet their obligations even during economic downturns or unforeseen crises. For individuals and businesses alike, the stability of an insurer can mean the difference between navigating adversity with confidence or facing added uncertainty in already challenging circumstances.

High insurance ratings are particularly important for long-term financial commitments, such as life insurance policies, annuities, and commercial property coverage. An “investment grade” rating for an insurance provider reassures customers that their policies are backed by sound financial practices and a robust reserve system. This category explores the factors that influence insurance ratings, such as underwriting discipline, capital adequacy, risk management, and market positioning, and highlights the evolving role of these ratings in a rapidly changing financial landscape.

Insurance Ratings and Their Impact on CRE Developers and Homeowners

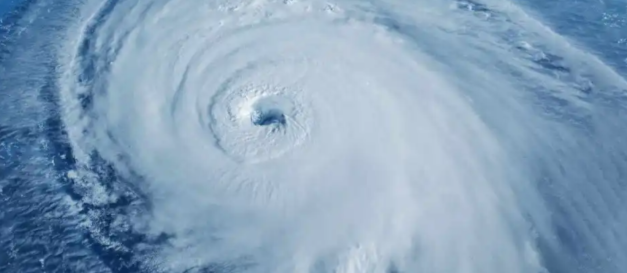

In the world of Commercial Real Estate (CRE), insurance plays a pivotal role in shaping the financial feasibility of projects. Rising insurance premiums in certain markets are putting pressure on developers, property owners, and homeowners, affecting everything from construction costs to operational budgets. As climate risks intensify and regulations evolve, insurance providers are reassessing risk profiles, which can result in higher premiums or even reduced coverage availability for properties in high-risk areas. These changes, driven by shifts in underwriting criteria and risk models, are directly linked to the financial health of insurers and their ability to adapt to emerging challenges.

For CRE developers, rising insurance rates can erode profit margins, complicate project financing, and increase the cost of maintaining properties. Markets prone to natural disasters—such as coastal regions facing hurricane risks or areas affected by wildfires—are particularly vulnerable. Higher premiums can deter lenders, complicate debt servicing, and force developers to reassess the economic viability of their projects. Similarly, for homeowners, rising insurance costs often translate to higher monthly expenses, which can reduce affordability and dampen demand in certain markets.

Investment Grade works closely with developers and property owners to mitigate the impact of rising insurance costs on their real estate portfolios. By collaborating with trusted partners and leveraging its market expertise, Investment Grade helps clients navigate the complexities of risk management, identify cost-saving opportunities, and align their insurance strategies with investment grade principles. Whether it’s negotiating better terms with insurers, structuring financing to account for increased premiums, or guiding acquisitions in lower-risk markets, we provide the insights and solutions that enable clients to stay resilient in a challenging environment.

Through this category, you’ll gain a deeper understanding of how insurance ratings affect the broader economy, how rising costs influence the CRE and residential sectors, and what steps you can take to navigate these challenges effectively. From evaluating the creditworthiness of insurers to adapting real estate strategies in response to changing insurance landscapes, we equip you with the knowledge to make informed decisions in a world where risk and opportunity are constantly evolving.

-

The Impact of Rising Insurance Costs on Maintaining Investment Grade CRE Properties

3rd March 2026 | by the Investment Grade Team

The increasing cost of insurance, particularly in areas prone to natural disasters, is reshaping the commercial real estate (CRE) landscape, posing significant challenges to maintaining investment grade property standards. Over the past decade, insurance premiums have surged, driven by the heightened frequency and severity of extreme weather events such as hurricanes, wildfires, and floods. The…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings