Investment Grade

Net Lease

Net Lease: A Cornerstone of Investment Grade Real Estate

Net lease properties are among the most stable and reliable investments in commercial real estate, offering a steady stream of income with reduced management responsibilities. At their core, net leases transfer operational costs—such as taxes, insurance, and maintenance—to tenants, creating a predictable revenue model that aligns with “investment grade” principles. In this category, we explore the unique advantages, opportunities, and strategies tied to net lease investments, focusing on how these properties deliver long-term value for investors.

The Appeal of Net Lease Investments

Net lease properties—particularly those structured as Triple Net (NNN) leases—are highly sought after for their combination of stability and simplicity. These assets are often leased to creditworthy tenants, such as national retailers, healthcare providers, quick-service restaurants, and logistics companies. For investors, this means consistent cash flow backed by tenants with strong financial profiles. Additionally, net leases reduce the landlord’s operational burden, as tenants typically handle property expenses and upkeep, making these properties ideal for passive income seekers.

Net lease properties also excel in mitigating risk, especially when tied to investment-grade tenants. Companies like Amazon, Walgreens, and AutoZone often sign long-term leases, providing landlords with a secure revenue stream and reducing exposure to vacancy risks. By focusing on properties in strong locations with reliable tenants, net lease investments deliver both immediate income and long-term appreciation potential.

How Investment Grade Enhances Net Lease Opportunities

Investment Grade specializes in helping investors identify, acquire, and finance net lease properties that meet the highest standards of quality and performance. Whether you’re seeking stabilized assets leased to investment-grade corporations or exploring value-add opportunities with franchise tenants, we provide the expertise and resources to guide your decisions.

- Acquisition Assistance: We leverage our deep network of brokers and off-market channels to source NNN properties with high-credit tenants. Our team evaluates tenant financials, lease terms, and market conditions to ensure each acquisition aligns with your risk tolerance and financial goals.

- Financing Solutions: Net lease properties often qualify for highly favorable loan terms due to their low-risk profiles. Investment Grade partners with nearly a thousand lenders to help investors secure competitive rates and flexible terms tailored to the property’s characteristics, whether it’s a pharmacy leased to CVS or a logistics warehouse underpinned by a long-term Amazon lease.

- Portfolio Strategy: For investors looking to scale their holdings, we provide strategic guidance on building diversified net lease portfolios. This includes balancing asset types, geographic locations, and tenant industries to enhance resilience and optimize returns.

Net Leases in the Broader CRE Landscape

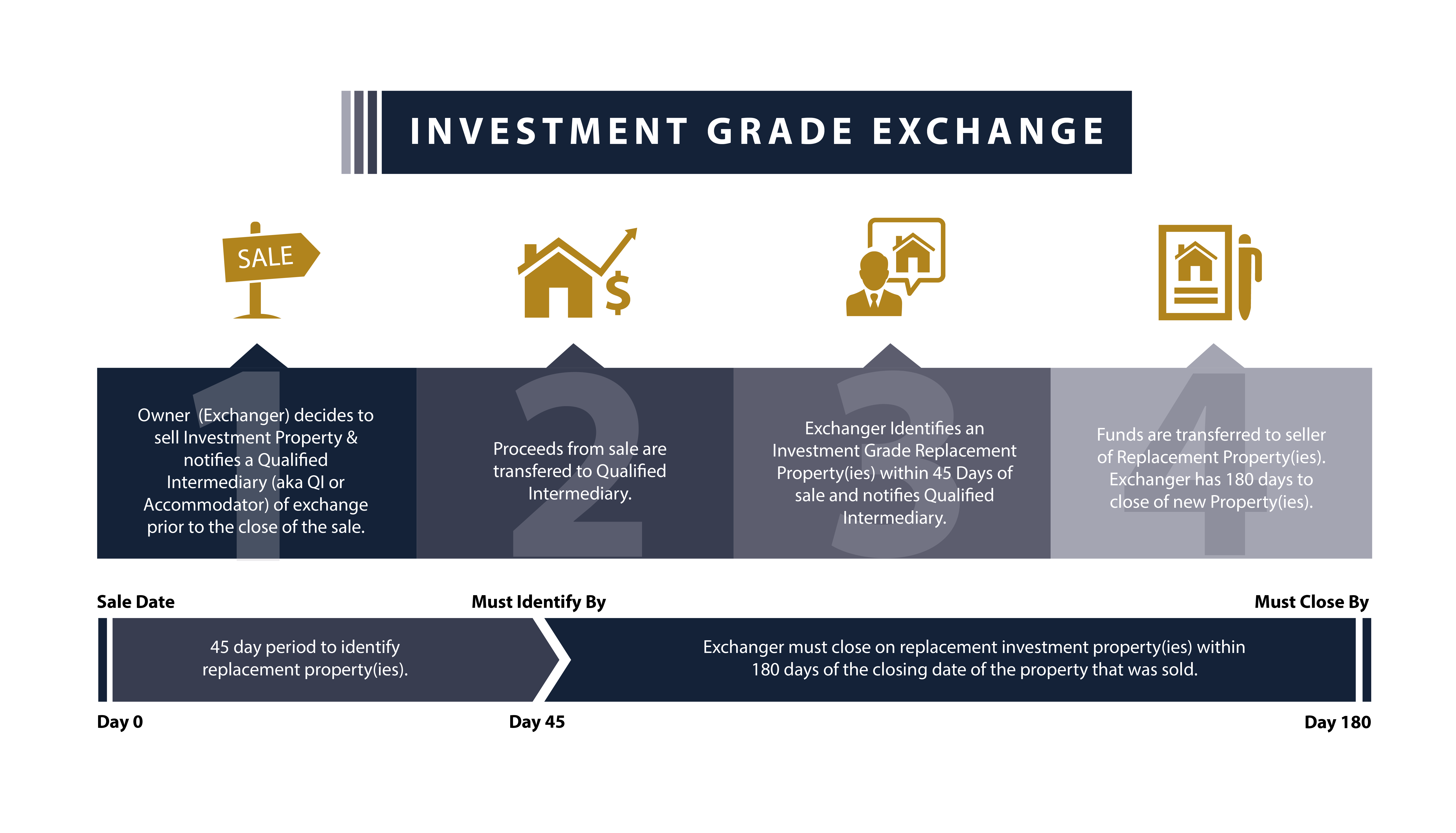

Net lease properties are not just attractive for individual investors—they are a staple in institutional portfolios as well. These assets fit seamlessly into 1031 exchanges, allowing investors to defer capital gains while reinvesting in stable, income-generating properties. They also complement syndication structures, providing passive investors with predictable returns and lower operational risks.

As market conditions evolve, net lease properties continue to adapt. Investors are increasingly exploring emerging sectors, such as healthcare and industrial net leases, which combine the stability of traditional NNN assets with the growth potential of dynamic industries. Investment Grade helps clients navigate these trends, ensuring that their investments remain aligned with both current opportunities and long-term goals.

Building a Future with Net Lease Investments

Net lease properties offer a rare combination of simplicity, stability, and scalability, making them an ideal choice for investors who prioritize predictable income and minimal management responsibilities. With Investment Grade as your partner, you gain access to a team that understands the nuances of the net lease market and is dedicated to helping you make informed, strategic decisions. Whether you’re acquiring a flagship retail property, refinancing an industrial asset, or expanding into healthcare NNN investments, we provide the tools and expertise to elevate your portfolio.

In this category, you’ll find detailed insights into the mechanics of net lease agreements, the financial dynamics that drive their value, and the strategies that maximize their potential. By focusing on creditworthy tenants, strategic locations, and flexible financing, Investment Grade ensures that your net lease investments deliver the security and returns you need to achieve your financial objectives.

-

100% Bonus Depreciation for NNN Investors — What the One Big Beautiful Bill Act Means for Net Lease Tax Strategy in 2026

23rd February 2026 | by the Investment Grade Team

The One Big Beautiful Bill Act permanently restored 100% bonus depreciation for NNN investors. Learn how cost segregation, the CRE debt maturity wall, and new tax provisions create a generational opportunity for net lease buyers in 2026.

-

7-Eleven Credit Rating

23rd February 2026 | by the Investment Grade Team

Creditworthiness & Financial Strength 7-Eleven stands as a formidable player in the convenience store sector with strong financial backing from its parent company, Seven & i Holdings Co., Ltd. The company maintains impressive credit ratings that reflect its financial stability and market dominance. Standard & Poor’s rates 7-Eleven with an ‘A’ long-term credit rating, while…

-

The Essential Guide to Due Diligence for Net Lease Properties

23rd February 2026 | by the Investment Grade Team

In today’s investment landscape, net lease properties have emerged as an attractive option for passive investors seeking stable, long-term income with relatively low risk. As a passive investor, the appeal lies in the steady cash flow generated by tenants responsible for most property-related expenses, such as maintenance, insurance, and taxes. However, while the concept of…

-

What is an Investment Grade Loan: Optimizing Your CRE Capital Stack

Introduction: Redefining Excellence in Commercial Real Estate Financing The Investment Grade Loan represents the gold standard in commercial real estate (CRE) financing, offering borrowers a meticulously tailored approach that optimizes their capital structure while meeting rigorous underwriting standards. Unlike conventional financing options, an Investment Grade Loan is engineered to align precisely with a borrower’s unique…

-

Medical Office Buildings: Making the Grade as Premium Investment Real Estate in 2025

23rd February 2026 | by the Investment Grade Team

In the diverse landscape of commercial real estate, medical office buildings (MOBs) have emerged as a standout investment-grade asset class. Long overlooked in favor of more traditional commercial properties, MOBs continue to demonstrate remarkable resilience, stability, and growth potential, particularly in today’s uncertain economic climate. As we navigate through 2025, the healthcare real estate sector…

-

Net Lease Investments: Stability in Uncertain Times

23rd February 2026 | by the Investment Grade Team

In today’s volatile economic landscape, characterized by fluctuating interest rates and persistent market uncertainties, investment-grade net lease properties continue to stand out as compelling vehicles for investors seeking reliable income streams combined with relatively lower risk profiles. As we navigate through 2025, understanding the nuances of this investment class has become increasingly important for investors…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings