Investment Grade

Capital

Capital fuels the engine of every thriving real estate investment, serving as the essential resource that transforms strategic visions into tangible, income-producing assets. In our “Capital” category, we shine a spotlight on the full spectrum of “investment grade” financing solutions, with a particular focus on Commercial Real Estate (CRE) debt. Whether you’re a first-time investor looking to secure favorable terms or a seasoned professional seeking the best possible rate and structure for your next acquisition or refinance, this category explores the dynamic tools and strategies that elevate your portfolio’s stability and returns.

In today’s competitive marketplace, gaining access to the right kind of capital isn’t merely about securing funding—it’s about structuring deals that align with long-term objectives. Our insights delve into everything from rate and term refinancing to cash-out refinancing and tailored acquisition loans, illustrating how “investment grade” standards influence the terms, rates, and covenants that lenders offer. By examining how nearly a thousand lenders and ten thousand programs converge to meet diverse asset requirements, we help you understand the critical factors that drive flexible financing options for NNN single-tenant properties, multifamily portfolios, industrial warehouses, healthcare facilities, hospitality venues, and more.

We break down the nuances of each CRE sector and the types of loans that best serve them. For instance, you’ll discover how stable, creditworthy NNN tenants can lower perceived risk, making it easier to achieve favorable financing. You’ll learn about the unique considerations behind financing a multifamily development, be it a garden-style apartment community or an active adult housing complex, and why quality sponsorship and long-term occupancy prospects matter. In the industrial realm, we discuss the role of sales-leasebacks and how they can unlock additional capital, turning otherwise static assets into strategic levers for growth. Healthcare and hospitality loans each have their own sets of metrics and market signals—our coverage explains how these factors shape loan terms, influencing both lenders’ comfort levels and your ultimate borrowing costs.

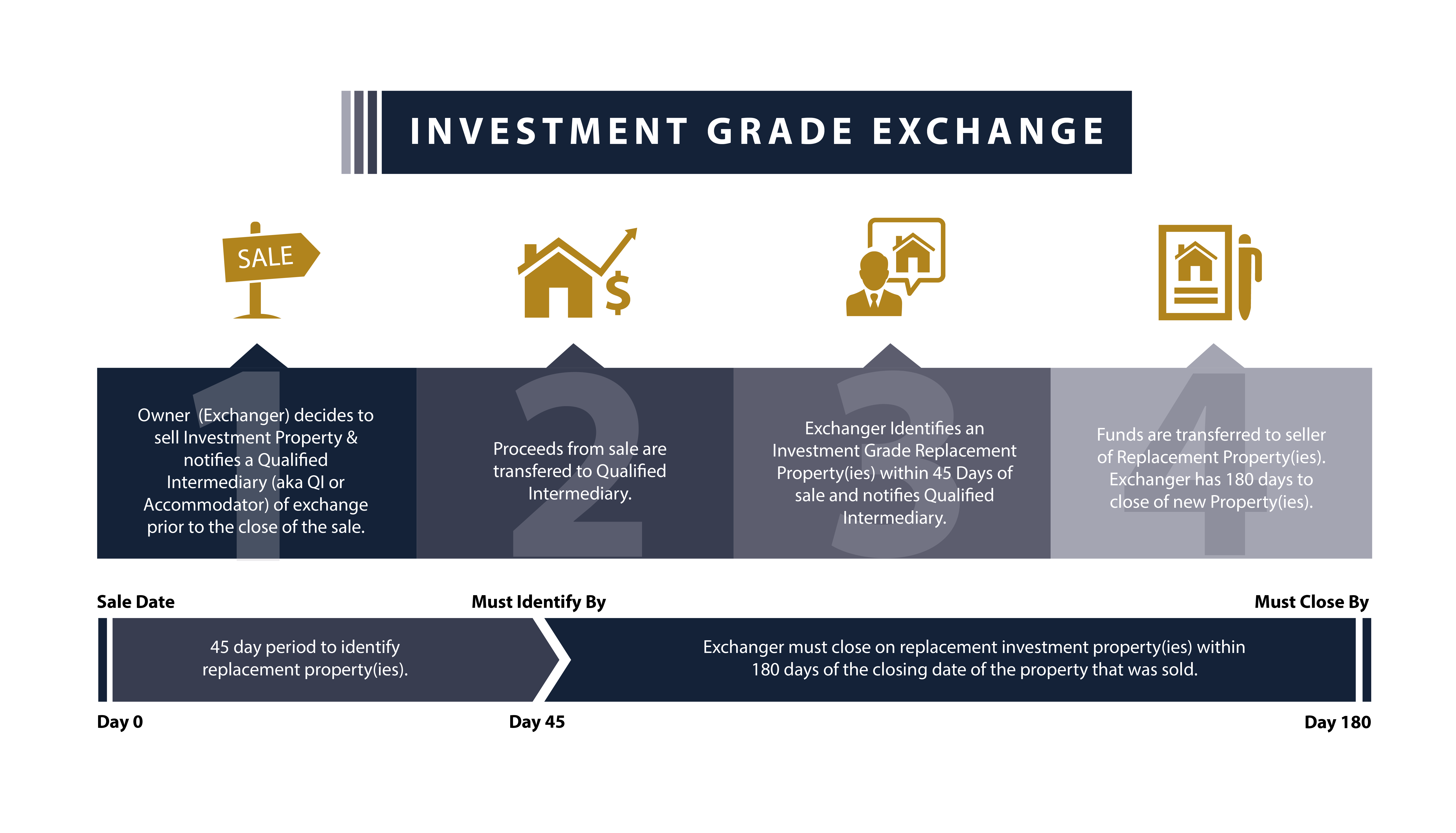

At its core, “investment grade” capital is about more than interest rates or loan-to-value ratios; it’s about constructing a resilient financial foundation. When your funding aligns with strong credit profiles, transparent underwriting, and a forward-thinking approach to market trends, you’re better positioned to adapt, grow, and thrive in evolving economic conditions. By drawing upon case studies, expert analysis, and emerging best practices, our “Capital” category equips you with the knowledge and perspective you need to approach CRE financing with confidence. Whether you’re exploring 1031 exchanges, institutional-grade multifamily acquisitions, or syndication advisory, having the right capital framework in place ensures that each strategic move supports your overarching goal: achieving and maintaining an investment grade standard across your entire portfolio.

-

Investment Grade M&A: Becoming an Investment Grade Company and Maximizing Your Exit Value

Selling your business is one of the most critical decisions you will ever make, not just financially, but also emotionally and strategically. The traditional M&A landscape is often transactional, focused narrowly on financial metrics, leaving substantial value on the table. Investment Grade M&A offers an entirely different approach: positioning your business strategically to become an…

-

Investment Grade vs. Non-Investment Grade Bonds: Risk Analysis, Returns, and Market Performance (25-Year Comparison)

In the world of fixed-income investing, few distinctions carry as much weight as the line between investment grade and non-investment grade securities. This comprehensive analysis examines the performance, risk characteristics, and behavior of these two asset classes across multiple economic cycles over the past 25 years. For investors seeking to optimize their portfolios, understanding the…

-

The Walgreens Takeover Investment Grade

18th February 2026 | by the Investment Grade Team

Sycamore’s $10B Walgreens Takeover: Investors Parse the Risks and Rewards Deerfield, IL & New York City (March 10, 2025) – Walgreens Boots Alliance’s journey as a public company is drawing to a dramatic close. In a deal that marks one of the largest leveraged buyouts in years, private equity firm Sycamore Partners agreed to acquire…

-

Grading the Capital Stack

18th February 2026 | by the Investment Grade Team

Optimizing the Capital Stack for Commercial Real Estate Investment In commercial real estate investment, understanding and optimizing the capital stack is akin to mastering the financial architecture of a deal. Much like a student’s GPA serves as a comprehensive measure of academic performance, a well-structured capital stack serves as the foundation for investment success. Navigating…

-

Investment Grade Capital Markets: The Gold Standard for Stability and Growth

18th February 2026 | by the Investment Grade Team

How Institutional Capital Moves and What Investors Need to Know Defining Investment Grade Capital MarketsInvestment Grade Capital Markets refer to the global financial arena where securities, real estate, and other assets are held to rigorous creditworthiness standards. Securities within this category are rated BBB- (or Baa3) and above by major credit rating agencies such as…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings