Investment Grade

Corporate

Corporate Investment Grade Ratings reflect a level of financial stability and credibility that goes well beyond simple balance sheets. These ratings are signals that a company—whether it’s a household name like Apple, an e-commerce titan like Amazon, or a well-established Real Estate Investment Trust (REIT)—has built a track record of dependable performance, manageable debt levels, and forward-looking governance. For investors, these insights illuminate not just the present health of a company, but also its capacity to weather business cycles, navigate regulatory changes, and compete effectively over the long term.

In this category, we focus on what it takes for a corporation to earn and maintain an “investment grade” rating. We look at how credit rating agencies factor in revenue stability, cash flow resilience, industry dynamics, and leadership quality when assigning these marks of credibility. A top-tier rating isn’t just a badge of honor; it’s a powerful asset that can lower borrowing costs, reassure lenders, and attract a broader base of investors. Companies with strong credit ratings often experience smoother paths to expansion, whether they’re negotiating acquisition terms, entering new markets, or rolling out new products and services.

For established technology leaders like Apple and Amazon, investment grade ratings signal that despite intense competition and rapid innovation, their financial fundamentals remain robust and disciplined. These giants leverage their strong ratings to secure favorable financing that fuels growth, supports research and development, and underpins strategic partnerships. For REITs, whose portfolios anchor entire segments of the commercial real estate market, achieving an investment grade rating can validate the quality of their assets, the consistency of their rental income, and the rigor of their property management strategies. In other words, high ratings can open doors to better financing deals, broader shareholder interest, and more resilient property cycles.

As you explore this category, you’ll gain insights into how corporations navigate the demands of both creditors and investors in their quest to achieve these top-tier ratings. We cover the metrics that matter most—like debt-to-equity ratios, interest coverage, and EBITDA margins—and how agencies interpret these figures. We also discuss the subtle differences between various rating agencies, and why certain companies might emphasize operational stability or environmental, social, and governance (ESG) credentials to strengthen their standing.

By understanding the forces that shape corporate investment grade ratings, investors can develop a more informed perspective on the opportunities these companies represent. Whether you’re comparing established giants to emerging firms that aspire to improve their financial standing, examining REITs for steady income potential, or evaluating a company’s ability to flourish amid changing global conditions, tapping into the insights within this category can help guide stronger, more confident investment decisions

-

Investment Grade Corporate Reporting

A plain‑English playbook for corporate reporting investors can actually use If you’ve ever opened a “sustainability report” and felt lost in acronyms, you’re not alone. In 2012, Making Investment Grade argued for disclosures that real investors could trust. In 2025, we finally have the scaffolding to do that—without jargon. This guide explains, in clear language,…

-

The 2026 Playbook for U.S. Investment Grade Corporate Bonds

A sector-by-sector tour of where income, risk, and relative value now sit Setting the Stage Investment-grade (IG) corporates entered 2026 in a rare position: all-in yields hover in the 5 % range—the highest carry investors have seen in more than a decade—yet credit spreads have compressed to multi-decade tights. In this environment the coupon you…

-

Investment Grade M&A: Becoming an Investment Grade Company and Maximizing Your Exit Value

Selling your business is one of the most critical decisions you will ever make, not just financially, but also emotionally and strategically. The traditional M&A landscape is often transactional, focused narrowly on financial metrics, leaving substantial value on the table. Investment Grade M&A offers an entirely different approach: positioning your business strategically to become an…

-

Moody’s 2025 Refresh: What Investors Need to Know About the New Rating Landscape

3rd March 2026 | by the Investment Grade Team

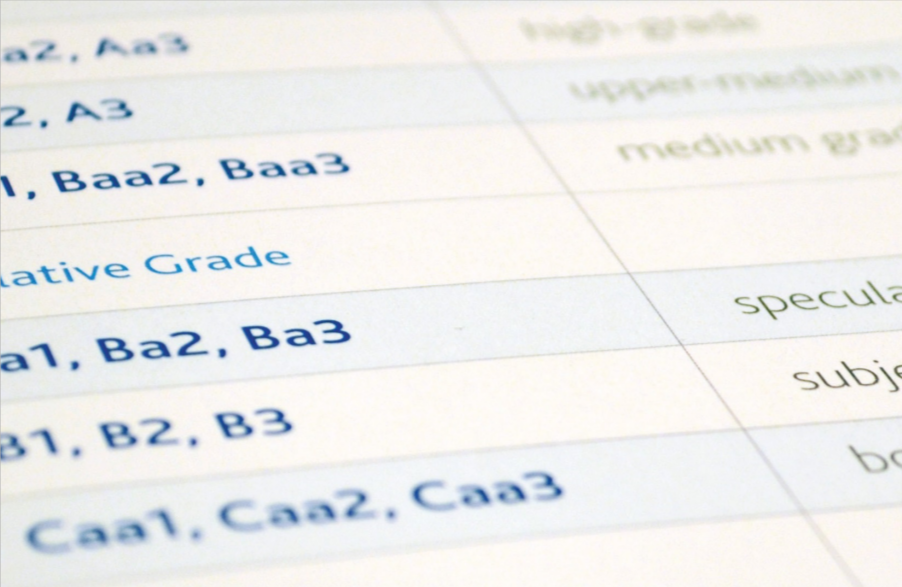

Moody’s 2025 Ratings Manual: Redefining Transparency and Clarity in Credit Markets Moody’s has unveiled its updated guide to investment grade rating symbols and definitions—a comprehensive reference that promises greater clarity in assessing credit risk in an ever‐evolving global financial landscape. Published as of January 2, 2025, the document details the evolution of Moody’s rating system—a…

-

Retail’s New Reality: Navigating Massive Store Closures and a Shift to Experience-Driven Leasing

3rd March 2026 | by the Investment Grade Team

Over the past several years, the retail industry has been rocked by seismic shifts in consumer behavior, technological disruption, and a reimagining of the traditional brick-and-mortar model. Nowhere is this transformation more evident than in the unprecedented wave of store closures reported over the past year. With more than 9,900 closures announced—outpacing new store openings…

-

From Defensive to Cyclical: Uncovering the Secrets Behind Today’s Investment Grade Corporate Bonds

3rd March 2026 | by the Investment Grade Team

In an era of shifting economic winds and rapid market evolution, the investment-grade corporate bond market stands out as a bastion of stability and opportunity. As investors navigate a world where interest rates, inflation, and various macroeconomic factors continuously redefine risk, corporate bonds offer a compelling blend of income and quality that can underpin even…

-

Investment Grade Auto NNN: A Guide to Acquiring Automotive Tenants

3rd March 2026 | by the Investment Grade Team

The automotive sector has evolved into a vibrant niche within the triple-net (NNN) lease market. Auto parts retailers, service centers, dealerships, and rental companies all play a significant role in delivering essential services, from routine maintenance to complex repairs. These businesses, often operating from standalone buildings or pad sites with long-term leases, are especially attractive…

-

Beyond Numbers: Elevating Corporate Reporting to Investment Grade

The landscape of investment grade corporate reporting has undergone a dramatic transformation in recent decades, driven by the evolving demands of investors, stakeholders, and regulatory bodies. Traditional financial reporting, once deemed sufficient to gauge an organization’s health, is now seen as incomplete in capturing the true value of a business. Today’s investment environment demands more…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings