Investment Grade

Institutional Grade

Institutional Grade represents the pinnacle of quality and performance in the investment world, where assets are meticulously vetted for their stability, creditworthiness, and long-term growth potential. In this category, we explore the characteristics and strategies that define institutional-grade investments, with a focus on real estate, debt instruments, and corporate assets. These are the types of opportunities sought after by pension funds, insurance companies, family offices, and other large-scale investors who demand the highest levels of reliability and scalability in their portfolios.

What Makes an Asset Institutional Grade?

Institutional-grade assets are distinguished by their market position, financial resilience, and appeal to sophisticated investors. In real estate, this typically includes Class A properties in prime locations, leased to creditworthy tenants with long-term agreements. These assets often boast high occupancy rates, consistent cash flows, and strong operational metrics. The stability of these investments makes them attractive not only for income generation but also for their ability to preserve capital during periods of economic uncertainty.

This category examines a wide range of topics, from the due diligence required to evaluate institutional-grade opportunities to the role of emerging trends like ESG criteria in reshaping what qualifies as high-quality investments. Whether you’re exploring large-scale multifamily developments, trophy office buildings, industrial portfolios, or commercial properties leased to Fortune 500 tenants, we provide actionable insights to help investors and institutions navigate these markets effectively.

How Investment Grade Supports Institutional Real Estate Transactions

Investment Grade specializes in assisting clients with institutional-grade real estate acquisitions and dispositions, providing a comprehensive suite of services tailored to meet the demands of high-stakes transactions. For acquisitions, we leverage our extensive network to identify off-market properties that align with your strategic objectives. These include Class A multifamily developments with 50+ units, industrial warehouses anchored by robust tenants, and NNN properties leased to investment-grade corporations . Our expertise ensures that every asset is carefully vetted for its creditworthiness, location, and growth potential, reducing uncertainty and enhancing your ability to close deals confidently.

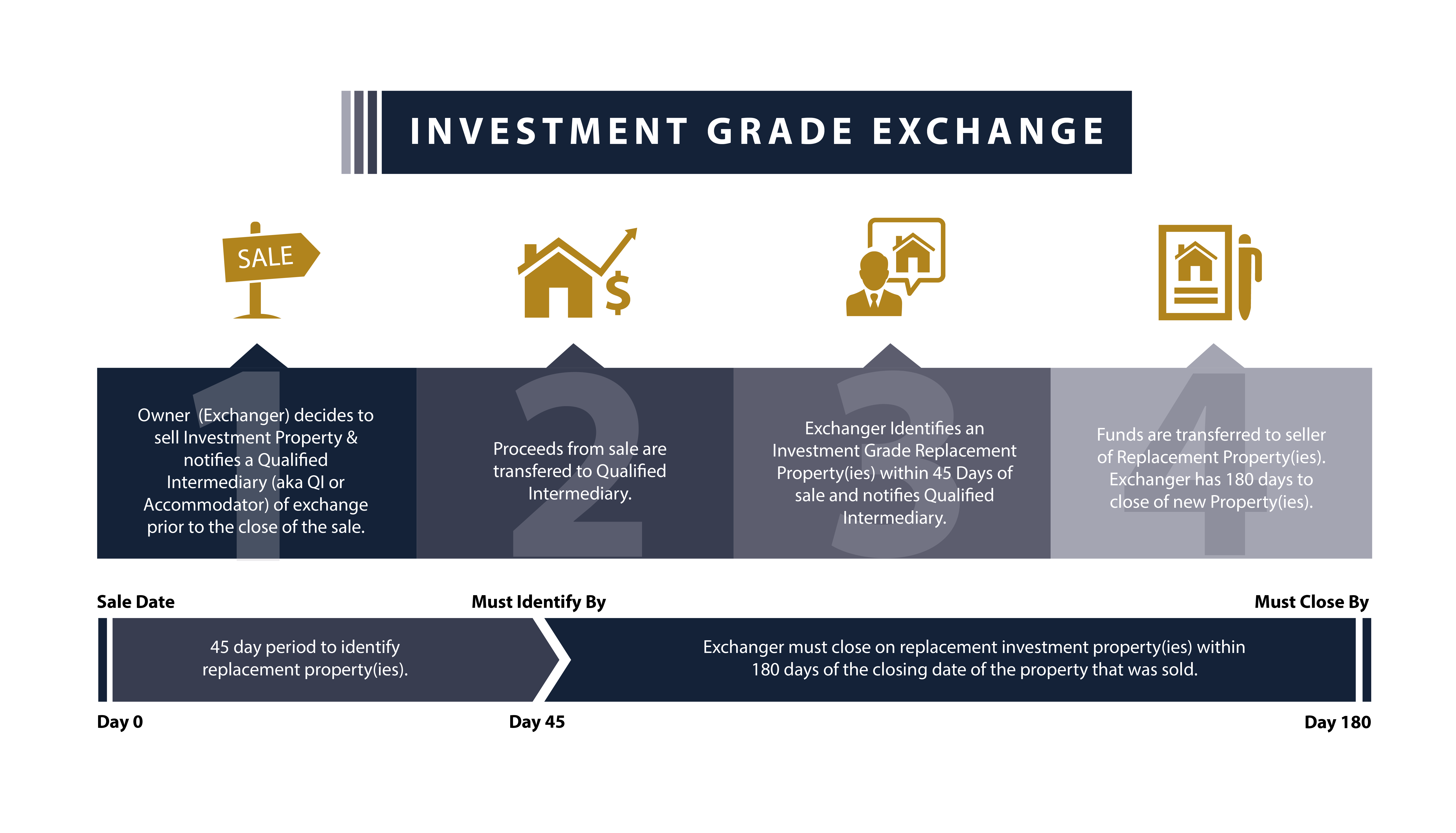

When it comes to dispositions, Investment Grade offers an efficient, market-savvy approach to help you achieve maximum value for your institutional-grade assets. We handle both on- and off-market transactions, leveraging our knowledge of local and national markets to position your property effectively. Our disposition services are backed by data-driven insights and an extensive buyer network, ensuring that your asset is not only sold but optimized for its highest possible return. For those navigating 1031 exchanges, we also provide specialized guidance to streamline the process, allowing you to defer taxes while reinvesting in new institutional-grade opportunities.

Whether you’re a seasoned institutional investor or exploring institutional-grade markets for the first time, this category delivers the insights, strategies, and tools you need to make informed decisions. By partnering with Investment Grade, you gain access to a team that understands the intricacies of these complex transactions and is dedicated to helping you succeed in the competitive world of institutional investments. From acquisitions to dispositions, we’re here to elevate your portfolio and ensure your strategies align with the principles that define institutional-grade excellence.

-

Three Investment Grade Net Lease REITs Positioned for Durable Income and Upside in 2026

17th February 2026 | by the Investment Grade Team

Realty Income (O), NNN REIT (NNN), Broadstone Net Lease (BNL)January 2026 Why Net Lease REITs Are Back in Focus The backdrop for real estate income investors has shifted meaningfully. Interest rates have peaked, financing costs are stabilizing, and new commercial supply is slowing sharply. At the same time, underlying demand for essential-use real estate remains…

-

The Walgreens Takeover Investment Grade

17th February 2026 | by the Investment Grade Team

Sycamore’s $10B Walgreens Takeover: Investors Parse the Risks and Rewards Deerfield, IL & New York City (March 10, 2025) – Walgreens Boots Alliance’s journey as a public company is drawing to a dramatic close. In a deal that marks one of the largest leveraged buyouts in years, private equity firm Sycamore Partners agreed to acquire…

-

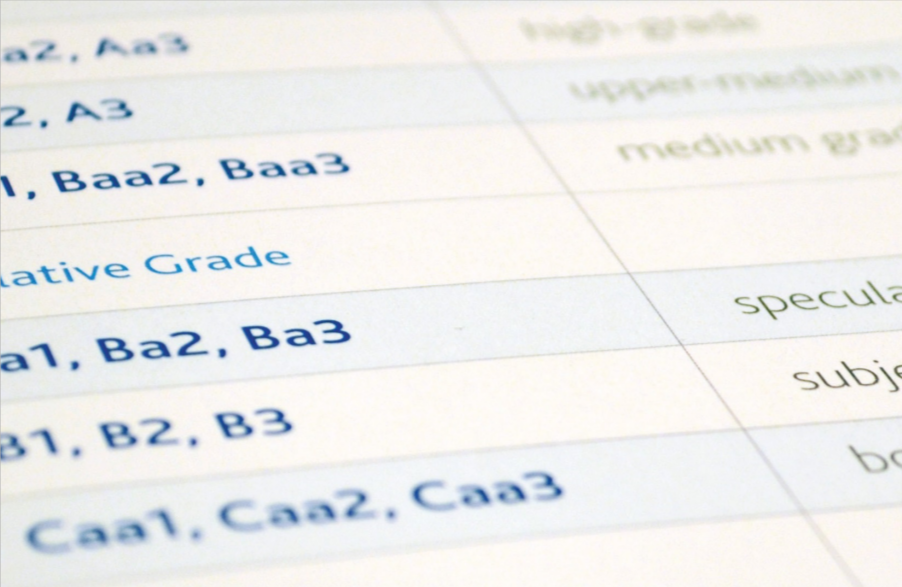

Moody’s 2025 Refresh: What Investors Need to Know About the New Rating Landscape

17th February 2026 | by the Investment Grade Team

Moody’s 2025 Ratings Manual: Redefining Transparency and Clarity in Credit Markets Moody’s has unveiled its updated guide to investment grade rating symbols and definitions—a comprehensive reference that promises greater clarity in assessing credit risk in an ever‐evolving global financial landscape. Published as of January 2, 2025, the document details the evolution of Moody’s rating system—a…

-

From Defensive to Cyclical: Uncovering the Secrets Behind Today’s Investment Grade Corporate Bonds

17th February 2026 | by the Investment Grade Team

In an era of shifting economic winds and rapid market evolution, the investment-grade corporate bond market stands out as a bastion of stability and opportunity. As investors navigate a world where interest rates, inflation, and various macroeconomic factors continuously redefine risk, corporate bonds offer a compelling blend of income and quality that can underpin even…

-

Investment Grade Data Centers: A Comprehensive Analysis of Opportunities and Challenges

17th February 2026 | by the Investment Grade Team

The data center industry is undergoing a transformative era, driven by the escalating demand for digital services, cloud computing, and the rise of artificial intelligence (AI). This unprecedented growth has positioned data centers as a vital component of the digital economy, offering substantial opportunities for investors. JLL’s 2025 Global Data Center Outlook highlights the extraordinary…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings