Investment Grade

Agencies

Agencies sit at the very core of what defines “investment grade” in today’s global financial ecosystem. They are the authoritative voices, the seasoned evaluators who shape perceptions of creditworthiness, guiding investors through a maze of complexity and uncertainty. In this category, we delve deep into how these institutions—ranging from world-renowned names like Moody’s, S&P Global Ratings, and Fitch Ratings to emerging players focused on niche markets—set the standards that influence everything from corporate bonds and sovereign debt to real estate-backed securities and innovative, ESG-infused financial instruments.

Our articles explore the evolving methodologies agencies use to determine whether a security or issuer deserves that coveted “investment grade” designation. We look at the quantitative metrics—interest coverage ratios, debt-to-equity structures, liquidity levels—and the qualitative factors—from corporate governance and industry positioning to regulatory landscapes and geopolitical risks—that feed into their rigorous evaluations. By understanding the metrics and the subtle artistry behind their determinations, you’ll gain the context necessary to interpret ratings, anticipate changes, and capitalize on both stable and emerging opportunities in the market.

Beyond simply explaining how agencies assign credit ratings, we highlight their growing influence on shaping broader financial narratives. As sustainable financing and green bonds capture investor attention, agencies are adapting their frameworks to consider environmental impact, social responsibility, and governance quality. Our coverage will illuminate how these shifts in evaluation criteria affect the final “investment grade” seal of approval and what that means for long-term portfolio stability. You’ll learn how agencies balance traditional financial indicators with newly recognized metrics of corporate stewardship, driving capital toward entities that demonstrate resilience, adaptability, and ethical responsibility.

The category also offers a lens into the interplay between agencies and various market participants. We discuss how institutional investors rely on these ratings for portfolio construction, how issuers tailor their strategies to achieve and maintain an investment-grade rating, and how policymakers and regulators respond to the critical role agencies play in financial stability. Articles may compare the approaches of different agencies, examine case studies where organizations successfully transitioned from speculative to investment-grade status, and outline scenarios where downgrades sent shockwaves through entire sectors.

Whether you’re an experienced investor refining your strategy or a newcomer eager to learn the basics, our “agencies” category empowers you with insights that blend authoritative analysis, practical guidance, and forward-looking perspectives. From understanding the building blocks of a rating decision to exploring how agencies adapt to emerging trends, you’ll come away with a clearer vision of how the people behind these ratings influence the flow of capital, the stability of global markets, and the opportunities that lie ahead. In a world where informed decision-making can make all the difference, a firm grasp on how agencies shape the investment-grade landscape will serve as your compass, guiding you toward informed choices and confident engagement with the markets.

-

7-Eleven Credit Rating

3rd March 2026 | by the Investment Grade Team

Creditworthiness & Financial Strength 7-Eleven stands as a formidable player in the convenience store sector with strong financial backing from its parent company, Seven & i Holdings Co., Ltd. The company maintains impressive credit ratings that reflect its financial stability and market dominance. Standard & Poor’s rates 7-Eleven with an ‘A’ long-term credit rating, while…

-

Investment Grade Credit Tenant Ratings

3rd March 2026 | by the Investment Grade Team

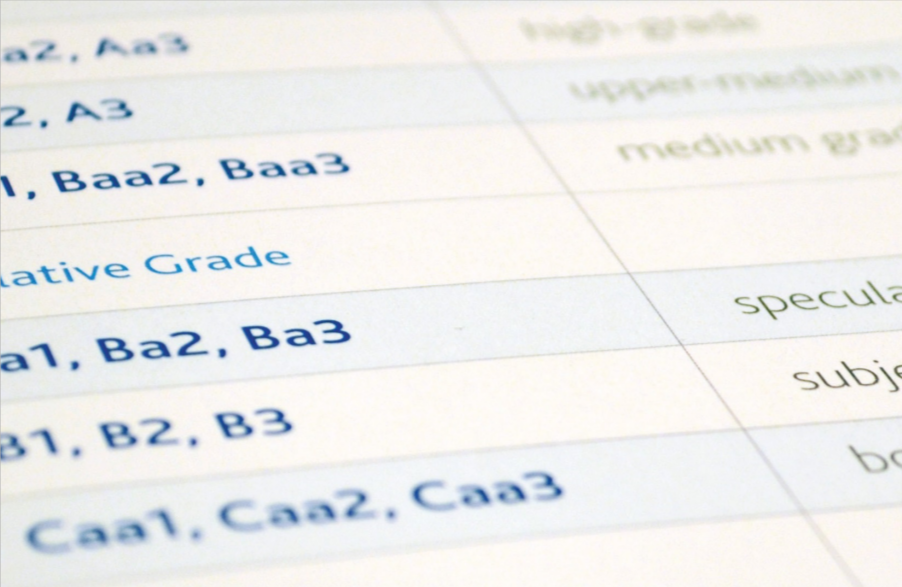

Investment Grade Credit Rating Chart Index INVESTMENT GRADE TIER GRADE S&P MOODY’S PRIME AAA AAA Aaa HIGH GRADE AA+ AA+ Aa1 AA AA Aa2 AA- AA- Aa3 UPPER MEDIUM GRADE A+ A+ A1 A A A2 A- A- A3 LOWER MEDIUM GRADE BBB+ BBB+ Baa1 BBB BBB Baa2 BBB- BBB- Baa3 NON-INVESTMENT GRADE SPECULATIVE BB+…

-

Moody’s 2025 Refresh: What Investors Need to Know About the New Rating Landscape

3rd March 2026 | by the Investment Grade Team

Moody’s 2025 Ratings Manual: Redefining Transparency and Clarity in Credit Markets Moody’s has unveiled its updated guide to investment grade rating symbols and definitions—a comprehensive reference that promises greater clarity in assessing credit risk in an ever‐evolving global financial landscape. Published as of January 2, 2025, the document details the evolution of Moody’s rating system—a…

-

Retail’s New Reality: Navigating Massive Store Closures and a Shift to Experience-Driven Leasing

3rd March 2026 | by the Investment Grade Team

Over the past several years, the retail industry has been rocked by seismic shifts in consumer behavior, technological disruption, and a reimagining of the traditional brick-and-mortar model. Nowhere is this transformation more evident than in the unprecedented wave of store closures reported over the past year. With more than 9,900 closures announced—outpacing new store openings…

-

From Defensive to Cyclical: Uncovering the Secrets Behind Today’s Investment Grade Corporate Bonds

3rd March 2026 | by the Investment Grade Team

In an era of shifting economic winds and rapid market evolution, the investment-grade corporate bond market stands out as a bastion of stability and opportunity. As investors navigate a world where interest rates, inflation, and various macroeconomic factors continuously redefine risk, corporate bonds offer a compelling blend of income and quality that can underpin even…

-

Investment Grade Dollar General: An In-Depth Analysis for Passive Income Investors

3rd March 2026 | by the Investment Grade Team

Contributor: Eli Schultz Dollar General has become a cornerstone for many passive real estate investors, especially those seeking NNN (triple-net) leases backed by an investment grade tenant. With thousands of small-format stores across the country, this discount retail giant offers steady cash flows, minimal landlord obligations, and a resilient business model. This analysis dives deep…

-

The Role of Credit Rating Agencies in Determining Investment Grade Status

3rd March 2026 | by the Investment Grade Team

Investment Grade credit rating agencies (CRAs) serve as a cornerstone of global financial markets, providing assessments of credit risk that influence investment decisions, borrowing costs, and economic stability. Organizations like Moody’s, Standard & Poor’s (S&P), and Fitch play a pivotal role in assigning investment-grade ratings, which signify an entity’s strong financial health and low default…

-

Guide to Investment Grade Securities

Investment Grade Securities play a crucial role in the world of finance. Whether you are an individual investor or a institutional player, understanding the ins and outs of this asset class is essential for making informed investment decisions. In this comprehensive guide, we will delve into the definition and importance of investment grade securities, explore…

Investment Grade | Investment Grade Real Estate | Investment Grade Capital | Investment Grade Ratings